Will Saudi Arabia be able to export renewable energy using green hydrogen in next five years?

Amidst the growing competitiveness among countries to become a world leader in green energy transition, Saudi Arabia is forging ahead with renewable projects. The oil-rich Gulf region is among the areas that can benefit most from the rising global appetite for renewable energy sources due to the abundance of land available for facilitating wind and solar projects. Besides, large natural gas reserves and geology offer immense opportunities for the country to develop blue hydrogen (produced from natural gas from carbon capture). Moreover, direct decision-making, existing modern infrastructure, and high investments make Saudi Arabia an excellent hydrogen first-mover. The country’s hydrogen policy is closely linked to Vision 2030, which assumes a holistic transformation through domestic value creation, non-oil exports, renewable energy, and the natural gas industry. Hydrogen produced from renewable sources can be turned into ammonia since it is easier to transport and store. Also, ammonia can itself be used as a fuel source or converted back to hydrogen. As the hydrogen used for producing ammonia is green, then the ammonia is also called green ammonia.

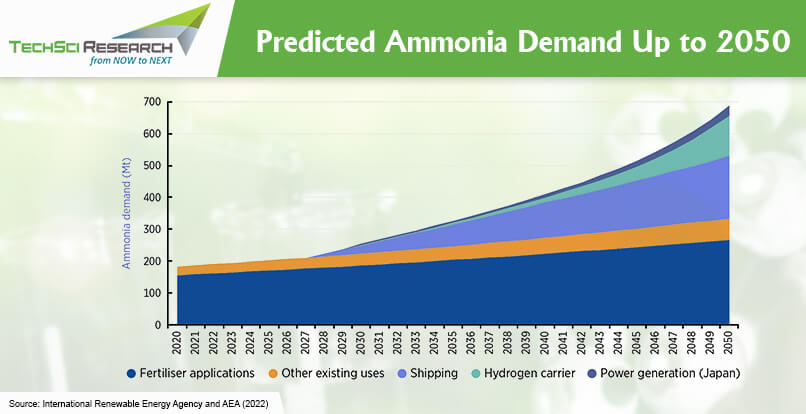

Today, half of the world’s population depends on ammonia for increasing their crop yields. Besides, ammonia has nine times the energy density of Li-ion batteries and three times that of compressed hydrogen, which makes it a potential alternative for carbon-free energy carrier. Moreover, as a carbon-free asset, green ammonia has several applications such as transport fuel for fuel cells vehicles, feedstock as green fertilizer, industrial energy source, etc. One of the main advantages of shifting towards green ammonia as a part of decarbonization strategy is that the production and distribution infrastructure is already mature at a relevant scale. However, utilizing renewable energy sources such as solar and wind energy can help produce green hydrogen and green ammonia in a climate-friendly way, without emissions. Switching to renewable electricity to produce ammonia could save 360 million tonnes of CO2 each year, worldwide.

In 2020, US’s Air Products, ACWA Power, and NEOM announced an investment of USD5 billion for establishing 4-gigawatt green ammonia plant in Saudi Arabia, which would be operational by 2025. Air Products plans to distribute the green ammonia globally and aims to fuel hydrogen fuel cells buses and trucks by supplying the energy at hydrogen refuelling stations. The initiative to build world’s largest green ammonia production plant is one of the first significant milestone of the many developments in the eco-city NEOM, a central vision outlining the kingdom’s plan to diversity Saudi Arabia’s economy. Based in the northwest Saudi Arabia, NEOM boasts a combination of perennial solar resources and ideal wind speed. The power plant with an annual capacity of 1.2 million tons of ammonia could satisfy renewable hydrogen demand, especially in the automotive sector, which would add to the country’s objective of decarbonization at such a large scale.

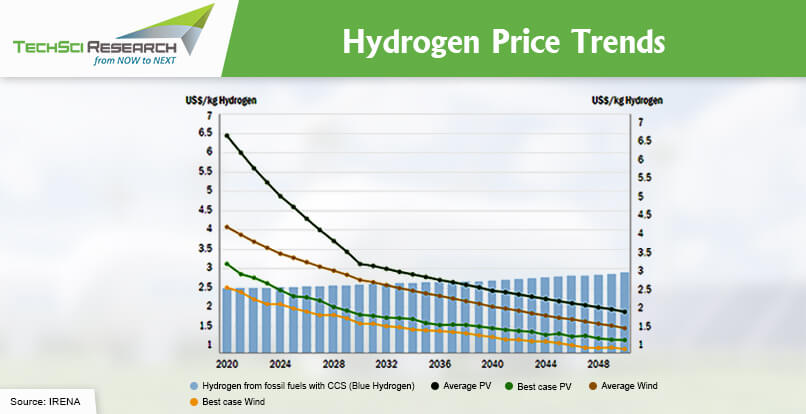

With a vision to diversify its export profile away from crude-oil in an increasingly carbon-constrained world, Saudi Arabia seeks to become a global supplier of green hydrogen. The vast number of hydrocarbon resources and existing industrial capacities can help the country become a potential supplier to those countries that have begun to explore alternate energy imports. Besides, abundance of solar and wind energy provides a significant opportunity for the energy suppliers to build renewables capacity and become market leaders. Green Hydrogen generation would allow Saudi Arabia to become less reliant on domestic oil, which contributes a significant portion to the country’s economy. Moreover, the development of clean hydrogen energy would echo the kingdom’s growing pursuit of a circular carbon economy. The domestic consumption of clean hydrogen would reduce the carbon profile of the Saudi economic activities and position the Kingdom as a facilitator of a global energy transition. The solar energy potential of Saudi Arabia is estimated to be 1000 TWh, which is nearly 17 times more than solar potential in Germany.

Saudi Aramco has announced a plan to produce 11 million mt/year of low-carbon hydrogen by 2030 with enhanced focus on exports. Recently, the state-controlled energy giant Saudi Aramco has signed an agreement with Hong-Kong based green hydrogen developer InterContinental Energy to build two huge hydrogen and ammonia plants, one in Australia and another in Oman. As Saudi Arabia plans to target hydrogen production — both blue and green — of 2.9mn t/yr by 2030 and 4mn t/yr by 2035, more such private investments could be expected.

Green Ammonia: Fuel of the Future

Several chemical companies are developing green ammonia, a route to ammonia in which hydrogen derived from water electrolysis powered by renewable energy replaces hydrocarbon-based hydrogen.

Collaboration of Saudi Arabia and Germany for Clean Hydrogen

In March 2021, Germany agreed to join hands with Saudi Arabia for the generation, processing, and transport of clean hydrogen. Although Germany has already started a large-scale effort to develop eco-friendly hydrogen to decarbonize its key industries, the country is seeking partnerships overseas to secure imports, owing to the rising domestic demand for hydrogen. Both Saudi Arabia and Germany has resources, required infrastructure, and skills to produce cost-competitive and low-carbon or clean hydrogen. Germany’s hydrogen strategy intends to accelerate the adoption of hydrogen technologies by 2030, providing €9 billion in funding (including €2 billion for international cooperation). A German import terminal is to be developed for the import of hydrogen and related products by Air Products and Mabanaft. The terminal would be operational by 2026 and be available to import green ammonia from Saudi Arabia. Additionally, liquified natural gas terminals are being built at the German coast to receive hydrogen from Saudi Arabia and reduce reliance on Russian imports.

Other Countries Joining the Hydrogen Race

Once a passionate advocate of nuclear energy, Japan now has some serious hydrogen ambitions as the country plans. Currently, Japan boasts the greatest number of hydrogen fuel stations and plans to increase the number from 160 (as of June 2021) to 1000 by 2030. Many Japanese corporations are actively building strategies to pursue opportunities overseas for developing low-carbon hydrogen production facilities, especially in Canada, Australia, and New Zealand to achieve carbon neutrality by 2050. The Japanese government has allocated a green innovation fund of 2 trillion Japanese yen to bolster the policy efforts for the introduction of renewable energies, drive adoption of clean energy vehicles, and accelerate research and development for the practical use cases of hydrogen and ammonia. The Research Center for a Hydrogen Energy-Based Society (ReHES) has been advancing technologies to make hydrogen energy a commercial reality.

Australia has ambitious plans to develop five giant “hydrogen hubs”, turning an area of desert more than twice the size of Luxembourg. The green hydrogen production facility is expected to utilize 10 million solar panels and 1500 wind turbines.

Reliable Supplier of Hydrogen

Saudi Arabia has remained a continuous and reliable supplier of oil to the world economy. The European Union has plans to import 10 million tonnes of green hydrogen from Gulf by 2030. European nations are having open discussions about needing huge supplies of green hydrogen to meet their decarbonization goals. Energy Prime Minister, Prince Abdulaziz bin Salman has announced the plan to invest one trillion riyals (USD266 billion) to make the country the world’s leading exporter of clean hydrogen. The country is well-positioned to export hydrogen to Europe via pipeline, which would be a cheaper option for Europeans than long-distance shipping. Saudi Arabia has ambitions to produce 4 million mt/d of “clean” hydrogen by 2030, and the limit could be exceeded with the rising demands. Recently, Japan signed a memorandum of cooperation (MoC) with Saudi Arabia for circular carbon economy, carbon recycling, and production of clean hydrogen and ammonia.

Way Ahead

Air Products is also developing a world-scale hydrogen plant at Jubail, reforming natural gas with carbon capture technology, which could produce 420 mt/d of hydrogen. Favourable government policies that attract private investments, such as competitive auctions, and falling solar and wind costs are expected to fuel the growth of renewables in the region.

According to TechSci Research report, “Green Ammonia Market – Global Industry Size, Share, Trends, Opportunity, and Forecast, 2022-2032, Segmented By Production Method (Alkaline Water Electrolysis, Proton Exchange Membrane, and Solid Oxide Electrolysis), By End Use (Power Generation, Transportation, Fertilizers, Others), By Region”, the global green ammonia market is expected to grow at a significant rate during the forecast period. The market growth can be attributed to the increasing demand for renewable energy and stringent rules and regulations related to carbon emissions.

According to TechSci Research report on “Green Hydrogen Market – Global Industry Size, Share, Trends, Opportunity, and Forecast, 2017-2027, Segmented By Technology (Alkaline Electrolyzer, Proton Exchange Membrane Electrolyzer, Solid Oxide Electrolyzer), By Renewable Source (Wind, Solar PV, Others), By End Use Industry (Power Generation, Automotive, Chemicals & Petrochemicals, Others), By Region”, the green hydrogen is predicted to grow at a significant rate during the forecast period. The market growth can be attributed to the development of alkaline electrolysis process facilitating hydrogen generation and increasing investment by companies to produce green hydrogen.