Impact of Russia-Ukraine War on the Chemical Industry

As the Russia-Ukraine conflict is intensifying, the rift between the two countries have snowballed into causing a major economic turmoil across the globe. Several countries are directly or indirectly dependent on Russia and Ukraine for various commodities, which has severely impacted the price of food, energy, fertilizers, pharmaceuticals, etc. Russia and Ukraine are the biggest exporters of raw materials to markets around the world. Before war, Ukraine has a thriving synthetic chemical sector where thousands of novel compounds were being produced. Around 80% of all screening compounds used in the research and development of drugs were either manufactured in Ukraine or Russia.

How is Russia-Ukraine War Impacting Industries?

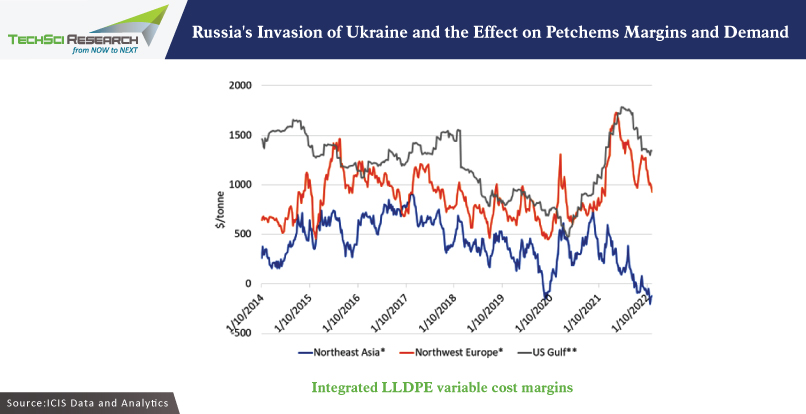

Prices of natural gas and crude oil are skyrocketing in Europe, which is forcing chemical producers to increase selling prices. This is putting them at an increasing disadvantage compared to competitors in the US, Asia, and Middle East. The war in Ukraine has pushed up feedstock and energy costs for chemical producers. Increasing fuel costs are causing inflation, leading to high freight rates. In addition, safety concerns have disrupted land and air transport routes via Ukraine and Russia, which has made rerouting even more expensive. Sanctions that western economies have put up against Russia are also impacting businesses in neighbouring countries such as Romania, Moldova, and Poland. Manufacturing plants in Lithuania, Latvia, and Estonia are considerably hit due to Russia-Ukraine war. Even countries that do not have trade restrictions are struggling to import from the region due to disrupted maritime transport sector. Thus, international trade of raw materials is severely impacting industries across the globe, especially the chemical sector.

The booming chemical industry in Germany depends on gas for 30% of its output and 44% for its energy consumption. 17% of the German chemical companies depend on Russian import of raw materials, required for the production and synthesis of chemicals. However, companies are scaling back production to save energy for the winters, which is expected to worsen the economic picture. More than 70% chemical producers and 80% manufacturing companies are struggling with the shortage of raw materials, intermediate products, and logistical woes. 90% of Germany’s petrochemicals-intensive industrial sectors such as machinery and equipment, electrical equipment, etc. are also reporting logistical troubles and shortage of materials. The gas-reliant pharmaceuticals sector has significantly reduced its production plants. Amidst the worsening of business climate in the country, car manufacturers are becoming reliant to hire staff. Germany’s car and chemical businesses are the biggest in Europe, which provide employment to thousands of people. With energy costs exploding, the competitiveness of the export industry is at stake.

Semiconductor Industry Under Threat with Neon Production Set to Go Down

Russia’s war in Ukraine is largely impacting the production of neon, a critical gas in advanced semiconductor manufacturing. Neon gas is required for the lasers used in chip production for a process known as lithography, where machines carve patterns onto tiny pieces of silicon. More than half of the world’s neon is produced by companies in Ukraine such as Mariupol-based Ingas, Cryoin, and Iceblick. These companies have shuttered their operations due to war, which has slashed the production of neon.

The worldwide neon consumption reached roughly 540 metric tons in 2021, out of which Ukraine produced over half of the world’s neon. Hence, the figure could fall below 270 metric tons if the nation’s neon producers continue to halt their production. The ongoing global chip crisis has already wreaked havoc on supply chains and led to lengthy delays for products, resulting into delayed delivery of automobiles, costly electronic items, etc.

Neon is a by-product of large-scale steel production, produced following fractional distillation of liquid air. 90% of the neon for the chip industry was produced as a by-product of Russian steel manufacturing and later refined by the companies in Ukraine. However, major chip manufacturers have already months of neon in reserve but smaller fabs with limited supply may be affected earlier.

Fertilizer Sector Worst Hit with N, P and K Shortage

Russia is a major producer and exporter of three main types of raw materials used to produce fertilizers such as nitrogen, phosphate, and potash. The country has a substantial potash and phosphate reserves in the world, which makes it a large N, P, and K production base. The cost of natural gas, key to fertilizer production, is also increasing. Since Russia has sharply cut back gas exports to Europe, the fertilizer industry is being severely impacted. Many countries are changing their crops or using less fertilizers and producing less amounts of food due to steep in prices of fertilizers or their unavailability. Countries in Africa and Latin America are the most vulnerable to the unavailability of these raw materials as it could lead to severe shortage of food. If the war persists, it will take years and billions of dollars worth investment to expand infrastructure and produce more fertilizers. Unstable fertilizer market could bring a food supply crisis and the world may run out of food.

Rapid Increase in Ammonia Costs

Ammonia is the principal source of nitrogen fertilizers and is predominantly manufactured from natural gas. The price of ammonia depends on the price of natural gas since ammonia plants require large volume of natural gas for synthesis. Around 13-14% of the world’s ammonia is supplied via the world’s longest ammonia pipeline—Togliatti Azot to Yunzhy port in Ukraine. BASF, the world’s largest chemical company, has announced to slash down the production of fertilizer and carbon dioxide. A reduction in gas supplies in Germany would intensify the shortage of fertilizers across the globe, leading to price increase for even basic foodstuff. Besides, ammonia is also used in the manufacturing of plastics, explosives, textiles, pesticides, dyes, and other chemicals. Ammonia prices are projected to increase globally with Europe set to witness a significant price increase as the Russia-Ukraine crisis is expected to worsen the already tight natural gas supply chain.

Tight Titanium Supply

Besides being a dominant supplier of resources such as oil, gas, and metals, Russia is also a significant exporter of titanium and titanium forgings. Long-term stoppage in the flow of these critical materials can lead to potential consequences. Titanium and their alloys have unique properties like high ratio of strength to weight, high resistance to corrosion, high heat resistance, etc. These properties have caused the metal to be widely used in the aerospace industry, chemical processing vessels, desalination plants, and medical applications. Besides, titanium dioxide is widely used in white paint, paper, plastics, and cosmetics. VSMPO-AVISMA Corporation, located in Russia, is the largest supplier of the titanium in the world. Sanctions and raw material embargoes can threaten the supply of significant portion of titanium, which could disrupt the growth of aerospace industry. However, Japan’s Toho Titanium, ATI Metals and RTI International Metals in the United States could be used as alternative sources for titanium products. European companies are already reconsidering their metal supply chain, but it would be difficult to completely cut off reliance from VSMPO, considering the scale of its market share and product base.

Soaring Nickel Prices

Price of nickel has been rising significantly over the past few months in response to the war in Ukraine. A reliable supply of nickel is essential for electric vehicle manufacturing since it is used in small amounts for lithium-ion batteries. Electric vehicle manufacturing giants like Tesla are concerned about the impact of possible future shortages of nickel as it could severely impact the production and demand of electric cars. Russia is one of the world’s top suppliers of high-grade nickel. In 2021, approx. 11% of global nickel production was done in Russia. However, several countries have reserves of nickel such as Indonesia, New Caledonia, the Philippines, Australia, Brazil and Cuba that might compensate the burgeoning demand for nickel, especially in the EV sector, in the years to come even if Russia-Ukraine war persists.

The chemical industry that fulfils the requirements of almost every industry such as raw material sourcing, processing, refinery, desalination, etc. is being severely impacted with the supply chain crunches caused by the Russia-Ukraine war. However, industry players are looking for alternative sources and strengthening domestic supply chain to pace their production and fulfil the evolving demands of consumers.