How Could Energy Crisis in Europe, UK, and China Impact India?

While “Sorry out of signs” has become ubiquitous at petrol stations in different parts of the United Kingdom, unprecedented power cuts in Northern China have left millions of homes and industries without electricity. At the same time, the skyrocketing energy prices across Europe are breaking records. The big multi-continental energy crunches are spilling into economic forecasts, supply chains, and beyond.

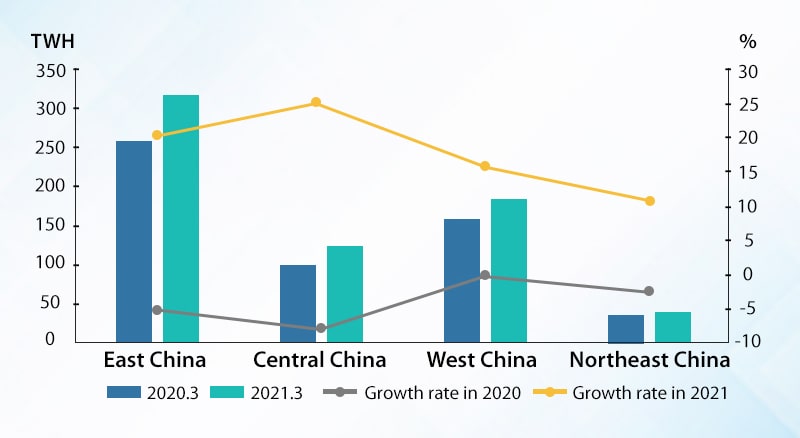

China’s Energy Crunch

The electricity-guzzling factories in China have halted their manufacturing operations due to power shortages caused by power rationing, thereby threatening China’s economic growth for the rest of 2021. Energy-intensive industries such as cement manufacturing, aluminum smelting, fertilizer production, etc., have been the hardest hit by the country’s power outages. More than 50% of coal-fired power plants are out of order as they are unwilling to operate at a loss, while many have drastically reduced their output. According to Goldman Sachs, the energy crunch in China has affected 44% of the country’s industrial activity, which could cause the world’s second-largest economy to expand only 7.8% this year, down from its previous prediction of 8.2%.

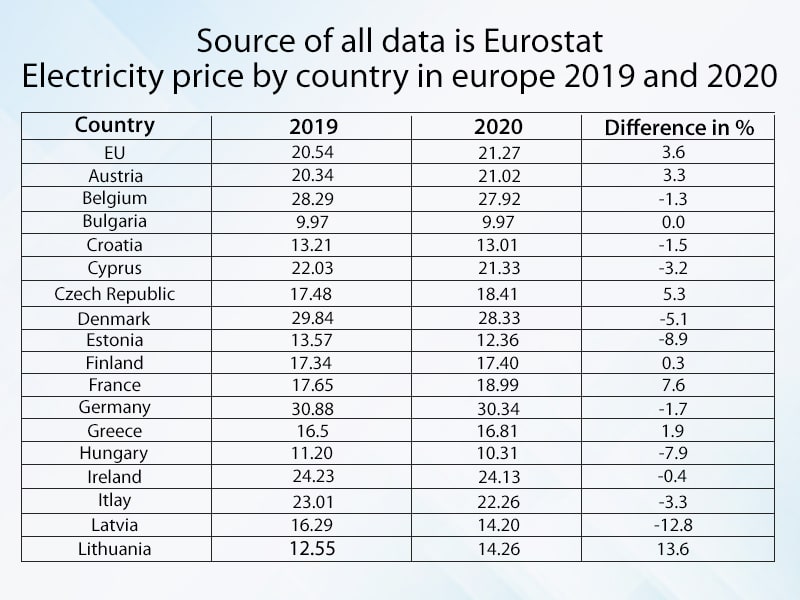

Europe’s Power Bills

As the European Union reduced the supply of emission credits, the carbon prices in EU countries surged above 60 Euros per metric ton in recent weeks. Electricity bills in some parts of Europe have nearly tripled in recent weeks. The economic rebound as countries lifted COVID-19 restrictions led to a sudden spike in energy demand. Russia has slowed its supply of piped natural gas to the region, resulting in soaring natural gas prices. Lacklustre output from windmills and social farms is aggravating the energy demand and shooting up power bills across the EU. Now, the economy making the righteous transition to clean and affordable energy has turned to burning coal to counter the energy crisis.

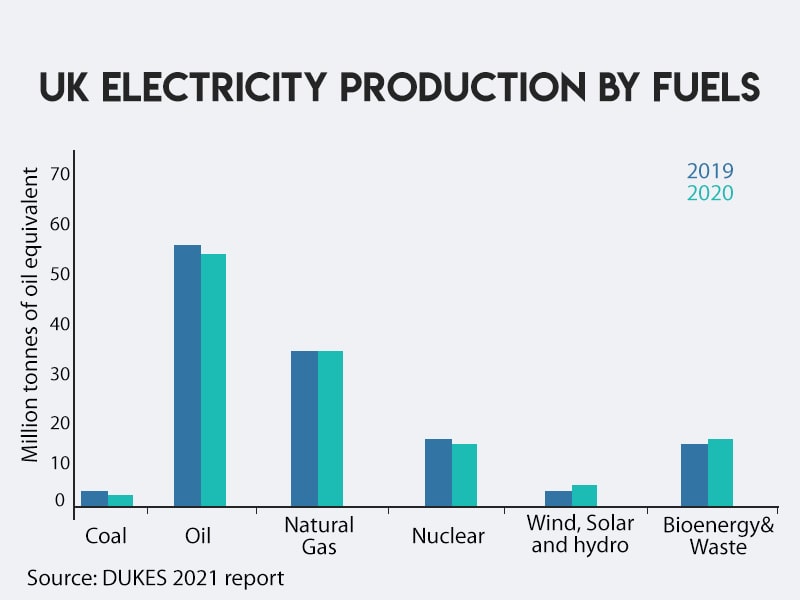

UK’s Worst Energy Disruptions

Since the start of August 2021, ten utility companies have collapsed in the United Kingdom, affecting thousands of households. Rising prices of natural gas and absent government support make it difficult for suppliers to cope with the rising electricity demand in the region. According to the trade association Oil & Gas UK, the wholesale gas prices have risen by 250% since the beginning of the year, resulting in quadruple power prices, ten times higher than the average.

Panic buying by motorists has left fuel pumps dry, causing the worst energy disruption in some of the major cities in the United Kingdom. The frustration caused by the lack of gasoline has led to fistfights at filling stations. The situation has got so critical that Prime Minister Boris Johnson’s government has been issuing visas to foreign truck drivers to get fuel to market and restore the pumps.

Forces at Play for the Global Energy Crunch

Overconsumption Post Pandemic

As the economies gradually recover from the pandemic, the energy demand has skyrocketed as business activity intensified and offices, restaurants, and other venues reopened their doors. According to a report by the International Energy Agency, the global energy demand will likely ramp up by 4.6% in 2021, pushing demand above 2019 levels. Global electricity demand is growing faster than renewables, which has accelerated the consumption of fossil fuels. The carbon emissions are set to increase by 1.5 billion tons in 2021 due to the resurgence of coal use in the power sector. Global coal demand is set to rise 4.5%; global oil demand will likely increase 6.2% in 2021, whereas global gas demand would exceed 2019 by 1%.

On the positive side, renewables will contribute to 30% of the overall electricity demand in 2021, up from 27% in 2019. The majority of the energy demand is expected to come from China and developing economies in the Asia Pacific region due to changing policy settings and economic trends. Rapid urbanization, growing demand for energy in the manufacturing factories, and growing population are some of the factors leading to the overconsumption of power, resulting in shortage of energy reserves and affecting the overall global economy.

· Extreme Weather Events Due to Climate Change

In Europe, winter lasted almost until May 2021, contributing to higher-than-usual gas demand for heating and power generation purposes. This led to a significant decrease in gas reserves, which were already limited due to insufficient supply from Russia, Norway, and Algeria. Generally, gas is relatively cheaper during summer, and companies seize the moment to store gas in vast amounts to prepare well for the winter months. But the ongoing price crisis due to high energy demands has disrupted the current reserves that have hit an all-time low at this time of the year. Europe energy storage levels were 15-18% less in 2020, which has led to high injection demand that supports spot prices. Europeans could face a hard time in the coming winter months as they might have to pay higher electricity and gas bills.

· Inadvertent Green Transitioning

Winter Olympics to be hosted by China in 2022 has prompted increased energy consumption in the country. However, in a bid to de-carbonize the economy and ensure clear skies, President Xi Jinping has cut down the import of coal, which has resulted in a dent in economic growth. Xi Jinping has set a target to bring down carbon emission to a peak by 2030 and net-zero to 2050 by fast-tracking renewables. Now, the lack of planning for green transitioning has led to disruption in energy equilibrium in China. European leaders and lawmakers blame EU climate policies to become carbon neutral by 2050 for the rampant gas price increases. The dependency on fossil fuels and natural gas has not decreased, which has led to energy poverty in Europe, affecting 34 million people.

High carbon permit prices have pushed natural gas prices by preventing gas-to-coal switch. The EU carbon allowance prices have reached an all-time high, and the prices are set to increase for the rest of the year. Since coal is more carbon-intensive, it requires more permits, which has created a cycle, pushing the electricity prices in Europe.

· Low Energy Output from Renewable Sources

Due to long periods of less windy weather, wind power generation in Europe has been far below average. Since the power output from potential renewable sources is less, gas and coal demand has risen, pushing up the energy prices. Climate changes have caused significant disruption to the renewables segment. Wind energy accounted for a quarter of Great Britain’s power, which has resulted in periods of cheap electricity. But now, UK wind farms produce less than 1 GW on certain days, which is very low compared to the energy output that windmills used to supply before.

How is the Global Energy Crisis Affecting India?

The sharp rise in global coal prices due to a severe shortage of other power alternatives came as a boon for domestic suppliers in India. The demand for coal has been soaring in the overseas market, for which Coal India and other suppliers have increased their output. Over 70% of India’s power comes from burning coal, while the share of natural gas is just about 5%. Hence, the rise in gas prices did not affect the electricity prices in India. However, the coal inventory reached critically low in August 2020, but the situation was resolved by diverting coal away from non-power uses. As the power demand is increasing from residences to factories, now the coal crisis is brewing up.

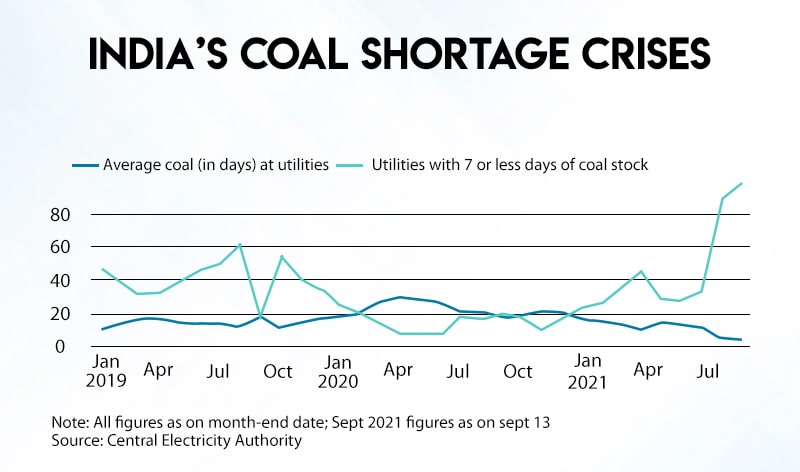

The coal stocks at power plants have hit an all-time low. Therefore, Indian utility companies are scrambling to secure coal supplies. Besides, the sluggish imports due to the global energy crisis are pushing power plants to the brink. India is the world’s second-largest coal importer, and utilities account for more than 3/4th of its overall consumption. More than half of the 135 coal-fired plants are left with fuel stocks of less than three days with the tightening supplies of coal and natural gas. India is competing against China to ramp up imports amid a severe power crunch to ramp up economic recovery from the COVID-19 pandemic. The import total for the most recent week was below 1.5 million tons, the lowest in the previous two years. Coal export prices in Indonesia have risen by 30% within the last three months, which is seven times higher for the similar quantity of coal sold to Indian utility companies by Coal India. Higher global prices of coal and freight rates are pushing the utility companies to curtail power production and depend on domestic coal-fired plants.

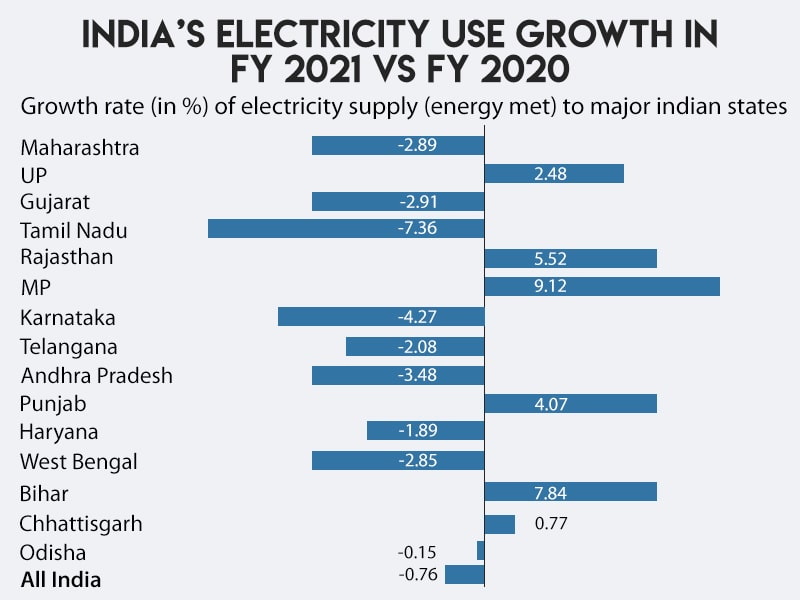

Although the electricity consumption fell drastically during coronavirus-imposed lockdown, the demand has increased rapidly since March 2021. According to Reuters, the power consumption in states like Maharashtra, Tamil Nadu, and Gujarat grew between 13.9% to 21% between July to September 2021. In addition, power consumption in less industrialized states in the east, such as Bihar and Chhattisgarh, has increased by over 10% compared with 2020, both for the quarter and six months ending on March 31, 2021. Industries and offices account for almost half the country’s annual electricity consumption ever since the economy has recovered.

Way AheadKeeping an eye on the climate goals set under the Paris Agreement, the transition from fossil fuel to renewable energy must not be done in a hurried and half-hearted approach. Speeding up the deployment of renewable energy sources can prove to be fundamental for curbing the energy crisis. Renewable energy diminishes the role of fossil fuels and shields the market from the supply crunch.

Visit : https://www.techsciresearch.com/consulting/c-consulting.aspx