Union Cabinet Outlays USD10 Billion to Boost Semiconductor Manufacturing in India

The global shortage of semiconductor chips has created immense distress as companies worldwide face challenges to meet the growing consumer demands for electronic goods and automobiles, and India is not immune to the global semiconductor crunch. Semiconductors are the ‘building block’ of billions of modern computing products, including smartphones, household appliances, life-saving pharmaceutical devices, data centers, smartphones, automobiles, and other tech products.

Rising Semiconductor Shortage in India

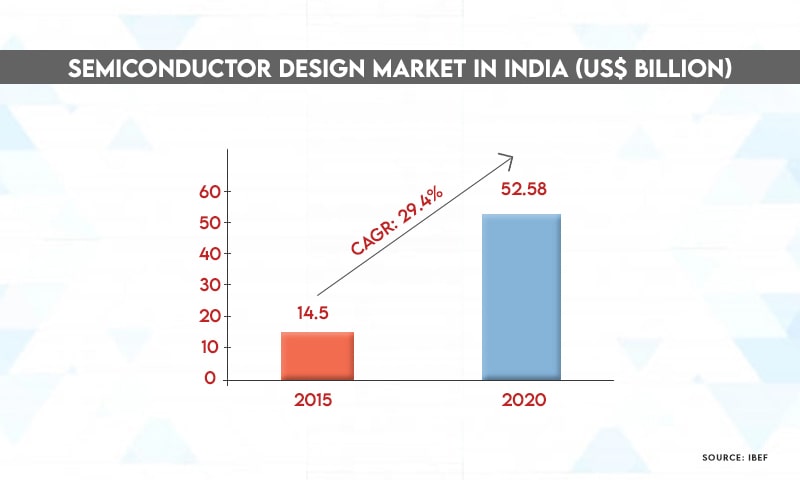

While the demand for microchips has catapulted across various segments with a sharp rise in demand for modern electronic goods and components, the lack of investment in chip building capacities and supply disruptions affects countless industries. The pandemic exposed India’s original equipment manufacturers’ soft underbelly and heavy import reliance on components. India’s semiconductor chips market currently stands at around USD24 billion and is anticipated to reach USD100 billion by 2025, according to Invest India. The factors attributing to the growth include rising demand for intelligent computing power, electric mobility, and connected vehicles.

The ongoing semiconductor chip famine is beginning to hit the Indian smartphone manufacturing market, the second-largest in the world after China. Operations at mobile manufacturers Lava and Micromax were almost halted after their chip seller MediaTek ran out of stock. The average selling price of certain smartphones has gone up 8-10%, which is weighing heavily on customers’ pockets. Besides, the supply chain crunch of semiconductors has led to a 5-10% reduction in the availability of personal computers and laptops. The shortage of microchips will further translate into more extended waiting periods and increased retail prices for consumers.

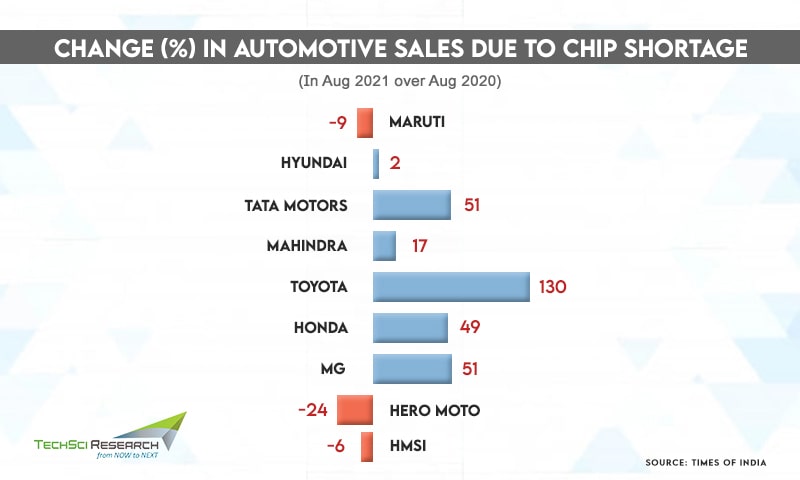

Automobile manufacturers are facing major heat as the manufacturing of many car components depends on semiconductors. In September 2021, automobile sales fell by 20% in India, declining to 1.71 million units compared to 2.14 million units in September 2020, as per the Society of Indian Automotive Manufacturers (SIAM). Many car companies like Maruti Suzuki, Mahindra & Mahindra, Nissan, Hyundai, MG Motors, Ford, Nissan, Fiat, Toyota, and others had cut production due to dried-up semiconductor supplies. The waiting period of car deliveries has increased from 2-3 months to 6-9 months for some car models with more electronics-driven features or higher semiconductor quotient. Major disruptions in the auto industry would directly impact the Indian economy as the sector contributes around 6.5% to overall the GPD and 35% to manufacturing GDP. Besides, the auto industry accounts for nearly 8% of India’s merchandise exports.

Public-Linked Incentive Scheme for Semiconductor Manufacturing in India

Union Cabinet recently approved an investment worth INR760 billion (approx. USD10 billion) for the Public Linked Incentive scheme intended to increase the domestic production of semiconductor chips and display boards in India. The financial boost comes to a much-needed relief for the handicapped automotive and consumer electronics sectors facing component shortages; however, its effect will be observed in the next 3-4 years. The scheme will help develop a semiconductor ecosystem for designing, manufacturing, packing, and testing microchips in the country. The government’s boost for semiconductor production is a step towards establishing India as a global hub for electronic goods, creating employment opportunities, and attracting more significant foreign investments.

As per estimates, the PLI scheme will create around 35,000 specialized jobs and one lakh indirect jobs while generating around INR1700 billion (USD22.5 billion) investments from international firms. The main strategic advantage of the PLI scheme is reduced dependence on semiconductor imports while generating revenue from exports to other countries. Currently, chip manufacturing is concentrated in a handful of countries like Taiwan, South Korea, the USA, Japan, and China. However, the Cabinet’s decision to outlay a sum of INR760 billion for the PLI scheme is a step in the right direction for expanding the scope of manufacturing and export, reducing import dependence, and ensuring sustainable development of the chip and display industry.

The PLI scheme aims to provide attractive incentives to companies engaged in silicon semiconductor fabs, display fabs, compound semiconductors fabs, semiconductor packaging, and designing. The scheme will offer companies concessions like waivers on custom duty, R&D activities, development expenses, interest-free loans, etc., to lure chipmakers and Indian conglomerates in moving into electronics and high-tech manufacturing. Although India has developed the required expertise for chip designing, the country lacks the infrastructure and high technology facilities called semiconductor fabrication units or fabs.

Currently, India has a handful of fabless start-ups and companies that focus on chip designing as fabs require hefty running costs and technology that needs to be upgraded every 3-4 years. With an investment of more than USD10 billion, the government plans to set up over 20 semiconductor design, components manufacturing, and display fabrication units within the next 5-6 years. Companies like Vedanta Group, Israel’s Tower Semiconductor, Apple’s contract manufacturer Foxconn, and Singapore-based consortium are showing interest in setting up fab units in India following the announcement of broad incentives by the government.

India’s Incentives for Semiconductor and Display Manufacturing.

- The PLI scheme shall extend fiscal support of up to 50% of the project cost on setting up semiconductor fabs and display units on a pari-passu basis to eligible applicants. Companies applying for the PLI scheme must have the required technology and capacity to execute highly capital and resource-intensive projects.

- The central government shall work closely with state governments to set up high-tech clusters with adequate infrastructure in terms of high-quality power, logistics, research ecosystem, semiconductor grade water, and land. These clusters would grant approvals to applications for establishing at least two greenfield semiconductor fabs and two display fabs in the country.

- The Ministry of Electronics and Information Technology will explore opportunities to modernize the Semi-conductor Laboratory (SCL) brownfield fab facility, forming associations with commercial fab partners.

- The scheme shall extend financial support of 30% of capital expenditure to approved units for setting up compound semiconductors/silicon photonics/sensors (including MEMS) fabs and semiconductor ATMP / OSAT units.

- The comprehensive package will extend product design linked incentive of up to 50% of eligible expenditure for semiconductor design companies.

- Product deployment linked incentive of 4-6% on net sales will be provided under the Design Linked Incentive (DLI) scheme.

- The scheme will support 100 domestic companies of semiconductor design for various components like integrated circuits, chipsets, system on chips, systems & IP cores.

- The scheme will facilitate the growth of not less than 20 such companies that can achieve turnover of more than INR 15000 million (USD197 million) over five years.

- India Semiconductor Mission (ISM) is proposed to drive long-term strategies to develop a sustainable semiconductor and display ecosystem in India.

· Why PLI Scheme for Semiconductor Chip Manufacturing is Crucial for Indian Economy?

The benefits of the PLI scheme intended for the development of the semiconductors and display manufacturing ecosystem will not be limited to just the semiconductor industry. Instead, the scheme will provide a significant advantage to other sectors involved with electronic manufacturing, where MSMEs are significantly present, ranging from smartphones to television, refrigerators to laptops, air conditioners to medical equipment, and more. The easy availability of components due to a boost in the local production of semiconductors will help the domestic electronic or smart device market grow more rapidly due to decreased prices of products. MSMEs will significantly benefit from supply chain ease with the expansion of fab and local manufacturing units in India, which would lead to the entry of more players. The automotive industry is the largest consumer of semiconductor chips, with the growing demand for electronic components that facilitate advanced features. If the supply of auto components comes to MSMEs from automakers, it will benefit small units more, which will aid inclusive growth in the country.

Despite the impressive growth of the electronic sector in India, the net value addition by these units is quite low (5%-15%) as most components are imported rather than locally sourced. Nearly 67% of electronic components are imported from China alone. The local value addition of India in the electronics segment is approximately USD7-10 billion out of a global market of USD2.1 trillion. This is because the value addition taking place in the final stages of production is lesser than the complicated processes that occur prior to assembly in upstream industries dealing with the production of processors, display panels, memory chips, cameras, etc. For greater value addition in the electronic segments, boosting indigenous capabilities in the upstream industries is crucial.

Out of 170 commercial foundries or fab units present across the globe, none of them is established in India, excluding fabs for Indian Space Research Organisation (ISRO) and Defence Research and Development Organisation (DRDO), restricted for space and defense systems. One of the primary reasons for the lack of fab units is that the major chip manufacturers like Intel, TSMC, and Samsung have cited uncertain domestic demand and poor cost efficiencies in India. Cost is a huge factor when it comes to setting up fab units as the plants require massive capital expenditure to the tune of USD2 billion or more. Besides, foundries require the adoption of newer technologies to keep up with the demand for high-quality products. Domestic players have not set up any foundries due to their inability to compete with tech giants in R&D.

Way Ahead

The level of support provided by the government to boost semiconductor production is minuscule, considering the scale of investments typically required to set up manufacturing units for various sub-sectors of the semiconductor industry. Besides, chip fabs require millions of liters of clean water and an extremely stable power supply, which the country lacks in significant regions. The scheme comes at a time when the world is severely facing a semiconductor crunch. So, the PLI scheme will not only boost the domestic production of semiconductor chips but also provide companies an opportunity to compete with companies globally. The development of key semiconductor fab units and display ecosystem will have a multiplier effect across multiple sectors of the economy and promote higher domestic value addition to electronics manufacturing. The PLI scheme will also contribute to India in achieving a USD1 trillion digital economy and USD5 trillion GDP by 2025.

More Details Visit : https://www.techsciresearch.com/