Understanding the Global Health Insurance Landscape

In an interconnected world where health risks transcend borders, the importance of robust health insurance coverage cannot be overstated. The global health insurance industry, a dynamic and multifaceted landscape, plays a crucial role in ensuring access to healthcare services for individuals and families worldwide. From innovative digital solutions to complex regulatory frameworks, the industry continually evolves to meet the diverse needs of a global population. In this blog, we delve into the intricacies of the global health insurance sector, exploring its diverse components and the challenges and opportunities they present.

What is Global Health Insurance?

Global health insurance stands as a beacon of assurance, offering a robust safety net of comprehensive medical coverage for both planned and unforeseen hospitalizations across the globe. In a world where the costs of medical care abroad often soar to exorbitant heights, the protective shield of global health insurance becomes nothing short of invaluable. It serves as a vital lifeline for individuals navigating unfamiliar healthcare systems in foreign lands, shielding them from the financial turbulence that can accompany unexpected medical emergencies.

The decision to opt for global health insurance is not merely a matter of financial prudence; it is an investment in peace of mind. With this insurance coverage in place, individuals can traverse borders with confidence, knowing that they have access to top-tier medical services in foreign countries without the looming shadow of financial worry. Whether it’s an unforeseen accident, an unexpected illness during international travel, or the pursuit of specialized medical treatment abroad, global health insurance stands steadfast in its commitment to provide comprehensive coverage.

The breadth of coverage offered by global health insurance is truly remarkable. It spans a wide spectrum of medical expenses, encompassing everything from hospitalization costs to consultations, diagnostic tests, emergency ambulance services, outpatient care, and beyond. This expansive coverage ensures that individuals facing medical emergencies abroad can receive the necessary treatment without facing crippling financial burdens. It provides a safety net that extends far beyond the borders of one’s home country, offering a sense of security and reassurance in the face of uncertainty.

One of the most noteworthy aspects of global health insurance is its inclusivity. Unlike traditional health insurance plans that may limit coverage to a specific geographical region, global health insurance extends its protective mantle to cover both domestic and international medical treatments. This means that individuals can receive quality healthcare services wherever they may find themselves, whether it’s in their home country or halfway across the world. This seamless continuity of care ensures that individuals can access the medical treatment they need, regardless of their location or circumstances.

Moreover, global health insurance transcends the boundaries of language and culture, providing a lifeline to individuals navigating unfamiliar healthcare systems in foreign countries. With access to a network of trusted healthcare providers and facilities worldwide, policyholders can rest assured knowing that they will receive the same standard of care regardless of where they seek treatment. This global network of providers ensures that individuals can access quality healthcare services that are tailored to their specific needs and preferences, regardless of their location.

In addition to its extensive coverage and global reach, global health insurance offers unparalleled peace of mind. It serves as a beacon of reassurance, offering individuals the freedom to explore the world without fear of the unknown. Whether it’s embarking on an adventure-filled vacation, pursuing career opportunities abroad, or simply enjoying the thrill of international travel, global health insurance provides a sense of security that transcends borders.

Who Should Take Global Health Insurance Policy?

A global health insurance policy is well-suited for several categories of individuals. Primarily, it caters to frequent travelers to foreign countries for business purposes, expatriates residing overseas, or individuals contemplating permanent relocation abroad. Additionally, it proves advantageous for those embarking on extended stays abroad for medical treatment purposes. The policy encompasses medical expenses, preventive care, and routine check-ups, extending coverage irrespective of the insured’s location, whether domestically or during international travel. Conversely, international travel insurance addresses contingencies specific to the trip, encompassing events like health emergencies, trip delays/cancellations, baggage loss, and other associated travel risks.

Diversity in Offerings:

One of the defining features of the global health insurance industry is the diverse array of products and services it offers. From basic medical coverage to comprehensive plans encompassing wellness benefits and international emergency assistance, insurers cater to a broad spectrum of needs. Moreover, the rise of specialized insurance products tailored to specific demographics, such as expatriates, students, and seniors, underscores the industry’s adaptability to diverse customer requirements.

These offerings may include:

- Comprehensive health insurance plans covering medical expenses, hospitalization, outpatient care, prescription drugs, and preventive services.

- Tailored packages for specific demographics such as expatriates, retirees, families, students, and individuals with pre-existing medical conditions.

- Flexible coverage options allowing customers to customize their plans based on their budget, coverage needs, and preferred healthcare providers.

- International network of healthcare providers, clinics, and hospitals to ensure access to quality healthcare services globally.

- Additional benefits such as emergency medical evacuation, repatriation, dental care, maternity care, mental health services, and wellness programs.

- 24/7 customer support, multilingual assistance, and online tools for easy access to information, claims processing, and medical assistance while traveling.

- Compliance with local regulations and standards in different countries to ensure legal compliance and seamless service delivery.

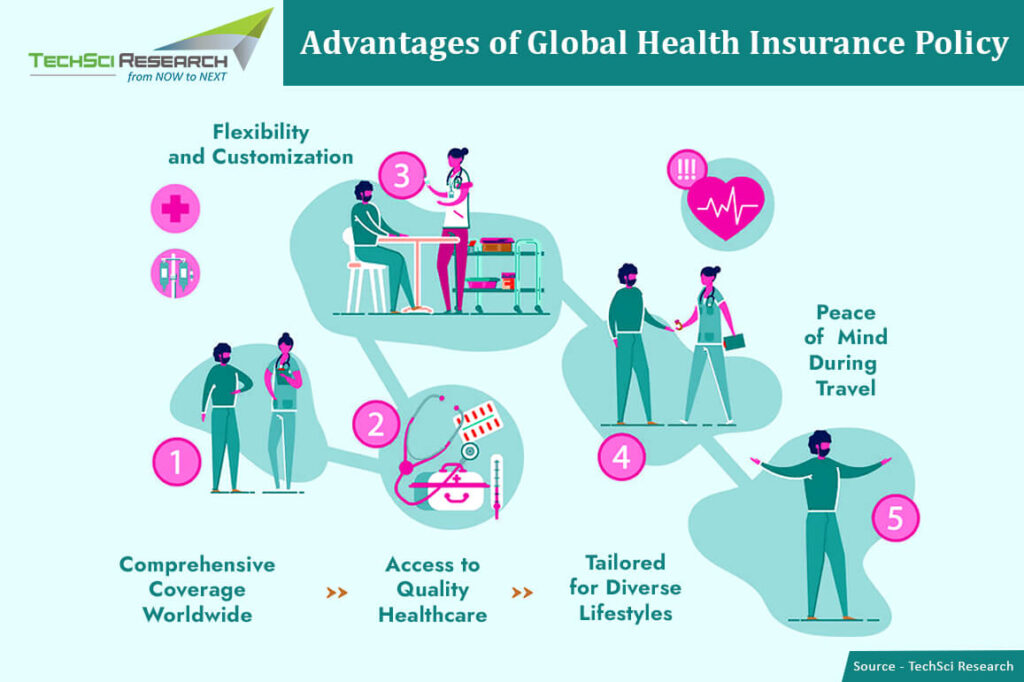

Advantages of Global Health Insurance Policy:

- Comprehensive Coverage Worldwide:

Global health insurance transcends geographical boundaries, providing coverage for medical emergencies and planned treatments regardless of location. Whether you’re on a business trip to bustling Tokyo or exploring the serene landscapes of the Swiss Alps, your health insurance ensures access to quality healthcare services without financial strain.

- Peace of Mind During Travel:

Traveling to unfamiliar territories can be exhilarating, but it also comes with inherent risks. With a global health insurance policy in place, the worry of exorbitant medical bills in the event of an unforeseen illness or injury dissipates. This peace of mind allows travelers to focus on their experiences without the nagging concern of healthcare expenses looming overhead.

- Tailored for Diverse Lifestyles:

From jet-setting executives to digital nomads and expatriates, global health insurance caters to a diverse spectrum of lifestyles. Whether you’re a frequent traveler for business, an adventurous explorer, or someone seeking new horizons for personal growth, this insurance ensures that your health remains protected wherever your journey takes you.

- Access to Quality Healthcare:

One of the standout advantages of global health insurance is access to a network of reputable healthcare providers worldwide. Whether you’re in a bustling metropolis or a remote corner of the globe, you can rest assured knowing that you’ll receive top-notch medical care when needed. This access to quality healthcare services ensures timely diagnosis, treatment, and recovery, regardless of location.

- Financial Security and Cost Savings:

Medical expenses abroad can often be staggering, posing a significant financial burden on individuals and families. Global health insurance mitigates this risk by covering a wide range of medical costs, including hospitalization, consultations, diagnostic tests, and emergency services. By avoiding out-of-pocket expenses, policyholders can enjoy substantial cost savings in the long run.

- Flexibility and Customization:

Global health insurance policies offer flexibility and customization options to suit individual needs and preferences. Whether you require basic coverage for emergency situations or comprehensive protection for routine healthcare needs, there are tailored plans available to accommodate various requirements and budgets.

Benefits of Tailored Global Health Insurance

Tailored global health insurance offers the advantage of customization, allowing you to align coverage with your specific requirements. This flexibility ensures that you only pay for the necessary coverage while guaranteeing adequate protection.

- Access to a Network of Healthcare Providers

Many insurers maintain partnerships with international healthcare providers. This network facilitates access to reputable hospitals and physicians in your destination country, ensuring the provision of high-quality medical care.

- Coverage for Travel-Related Risks

In addition to medical coverage, certain policies extend protection to travel-related risks such as trip cancellations or lost luggage. These supplementary benefits contribute to enhanced peace of mind during retirement travel.

- 24/7 Assistance

Seek out policies that offer 24/7 customer support and assistance. Emergencies can arise at any moment, and having a dependable point of contact proves invaluable in such situations.

Pros and Cons of Global Health Insurance

Pros:

- Comprehensive Coverage: Global health insurance often provides comprehensive coverage, including medical treatment, hospitalization, emergency evacuation, and repatriation, ensuring individuals have access to quality healthcare services wherever they are in the world.

- Flexibility: Many global health insurance plans offer flexibility in terms of coverage options, allowing individuals to tailor their policies to suit their specific needs, whether they are expatriates, frequent travelers, or retirees living abroad.

- Access to Quality Healthcare: With global health insurance, policyholders gain access to a network of healthcare providers, hospitals, and clinics worldwide, ensuring they receive timely and high-quality medical care, even in unfamiliar locations.

- Peace of Mind: Global health insurance provides peace of mind, knowing that one is protected against unexpected medical expenses and emergencies, reducing the financial burden and stress associated with seeking healthcare abroad.

- Emergency Assistance Services: Many global health insurance plans offer emergency assistance services, including 24/7 helplines, medical advice, and assistance with medical referrals and arrangements, ensuring policyholders receive prompt support in case of emergencies.

Cons:

- Cost: Global health insurance premiums can be relatively high, especially for comprehensive coverage with extensive benefits and worldwide access to healthcare providers. This cost may be prohibitive for some individuals or organizations, particularly those on a tight budget.

- Exclusions and Limitations: Like any insurance policy, global health insurance may have exclusions and limitations, such as pre-existing conditions, certain medical treatments, or high-risk activities, which may affect coverage eligibility or require additional premiums.

- Complexity: Understanding the terms, conditions, and coverage options of global health insurance policies can be complex, especially for individuals unfamiliar with insurance terminology or international healthcare systems. This complexity may lead to confusion or misunderstandings regarding coverage and benefits.

- Claim Process: The claim process for global health insurance can be cumbersome, involving paperwork, documentation, and communication with multiple parties, including healthcare providers, insurers, and third-party administrators. Delays or disputes in the claim process may result in frustration for policyholders seeking reimbursement for medical expenses.

- Cultural and Language Barriers: Accessing healthcare services in foreign countries may pose challenges due to cultural differences, language barriers, and differences in healthcare practices and standards. Policyholders may encounter difficulties navigating the healthcare system or communicating with healthcare providers, especially in non-English speaking countries.

Regional Disparities:

Despite efforts to achieve universal healthcare coverage, significant regional disparities persist in access to health insurance. While some countries boast well-established public or private insurance systems that provide extensive coverage, others grapple with fragmented or underdeveloped healthcare financing mechanisms. Bridging these gaps requires collaboration between governments, insurers, and healthcare providers to design inclusive policies and expand coverage to underserved populations.

Policy Interventions: Governments and regulatory bodies can implement policies and regulations aimed at improving access to healthcare services and promoting affordability and transparency in the health insurance market.

Innovative Solutions: Insurers can develop innovative solutions tailored to address the specific needs and challenges of different regions. This may include offering localized insurance products, leveraging technology to improve access to healthcare services, and partnering with local healthcare providers and organizations.

Education and Awareness: Increasing awareness about the importance of health insurance and how it works can help empower individuals to make informed decisions about their healthcare coverage. Education campaigns and initiatives can help bridge the gap in understanding and access to health insurance across regions.

Public-Private Partnerships: Collaboration between public and private sectors can lead to the development of sustainable healthcare systems and insurance markets. Public-private partnerships can help leverage resources, expertise, and infrastructure to improve access to healthcare services and expand insurance coverage in underserved regions.

Technological Advancements:

The integration of technology is revolutionizing the global health insurance landscape, driving efficiency, and enhancing customer experiences. From telemedicine platforms facilitating remote consultations to data analytics tools enabling personalized risk assessment, technology is reshaping how insurers deliver and manage healthcare services. Furthermore, blockchain technology holds promise for streamlining claims processing and enhancing data security, offering new avenues for innovation within the industry.

Regulatory Challenges:

Navigating the regulatory environment is a perennial challenge for health insurers operating across borders. Varying regulatory frameworks, compliance requirements, and consumer protection standards pose complexities for multinational insurers seeking to expand their presence globally. Furthermore, geopolitical factors and regulatory changes in host countries can impact insurers’ ability to operate and compete effectively, necessitating a nuanced understanding of local market dynamics.

Emerging Trends:

Several trends are reshaping the trajectory of the global health insurance industry, including demographic shifts, rising healthcare costs, and increasing consumer demand for personalized solutions. Insurers are responding by embracing value-based care models, investing in preventive healthcare initiatives, and leveraging digital platforms to engage with customers proactively. Additionally, the growing emphasis on sustainability and ESG (Environmental, Social, and Governance) considerations is prompting insurers to integrate responsible practices into their business strategies.

According to Techsci research report “Health Insurance Market– Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Insurance Provider (Public, Private, Standalone Health Insurers), By Type of Coverage (Individual, Family), By Term of Coverage (Term, Lifetime), By Mode of Purchase (Direct Company Representatives, Online Portal, Insurance Agent), By End Users (Minors, Adults, Senior Citizens), By Region, By Competition 2019-2029,” theGlobal Health Insurance Market is likely to grow at a robust pace in the forecast period. The market growth is driven by various factors, such as increasing healthcare costs, aging population and chronic diseases, rising awareness and importance of health coverage, technological advancements and digital transformation, and global health challenges such as COVID-19 pandemic.

Escalating Healthcare Costs:

The relentless rise in healthcare costs has emerged as a primary catalyst driving the demand for health insurance worldwide. From medical treatments and hospitalization to prescription drugs and diagnostic procedures, the financial burden associated with healthcare can be staggering. As individuals and families grapple with escalating expenses, the need for insurance coverage becomes imperative to mitigate the risk of financial hardship in the event of illness or injury.

Aging Population and Chronic Diseases:

Demographic shifts, including aging populations and the prevalence of chronic diseases, are reshaping healthcare dynamics globally. With longer life expectancies and a higher incidence of age-related ailments, there’s a growing demand for healthcare services and support systems. Health insurance plays a pivotal role in providing access to timely medical interventions, disease management programs, and long-term care solutions for aging populations and individuals battling chronic conditions.

Rising Awareness and Importance of Health Coverage:

Increasing awareness of the importance of health coverage is driving more individuals and organizations to prioritize insurance protection. As people become more cognizant of the unpredictable nature of health emergencies and the potential financial repercussions, they are proactively seeking comprehensive insurance solutions to safeguard their well-being and financial security. This heightened awareness has led to a surge in demand for health insurance products across diverse demographics.

Technological Advancements and Digital Transformation:

The convergence of healthcare and technology is revolutionizing the way medical services are delivered, accessed, and managed. From telemedicine and wearable devices to health tracking apps and data analytics, technological innovations are empowering individuals to take charge of their health and well-being. Health insurance providers are leveraging these advancements to enhance customer experience, streamline operations, and offer innovative insurance solutions tailored to evolving healthcare needs.

Global Health Challenges: COVID-19 Pandemic and Beyond:

The unprecedented impact of the COVID-19 pandemic has underscored the critical importance of health insurance in safeguarding individuals and communities against unforeseen health crises. The pandemic has heightened awareness of the vulnerabilities inherent in healthcare systems worldwide and the need for robust insurance coverage to navigate uncertain times. As global health challenges persist, including infectious diseases, natural disasters, and geopolitical instability, the demand for comprehensive health insurance is expected to continue rising.

Thus, embracing these growth drivers, health insurance providers have a unique opportunity to address evolving consumer needs and shape the future of healthcare delivery on a global scale.

Top Companies in the Global Health Insurance Market:

Now Health International (Investments) Limited

Now Health International stands out for its comprehensive health insurance solutions tailored for individuals and businesses worldwide. With a focus on flexibility and innovation, Now Health provides access to quality healthcare services globally, ensuring peace of mind for its customers. The company provides comprehensive health cover for the whole family wherever they may go. It also offers international cover for people getting their tertiary education abroad. It also provides a very comprehensive health insurance plan that has access to a network of over 1 million medical facilities and physicians worldwide. Now Health is a specialist insurer focused on worldwide cover and its staff are experts in local markets and global health cover.

Cigna Group

Cigna Group is a global health service company dedicated to improving the health, well-being, and peace of mind of those it serves. With a diverse portfolio of insurance products and services, Cigna offers tailored solutions to meet the unique needs of individuals, families, and businesses around the world. Cigna provides Medicare and Medicaid products and health, life and accident insurance coverages to individuals in the U.S. and selected international markets. In June 2020, Cigna formed a strategic alliance with Priority Health to make comprehensive health care coverage more accessible and affordable to customers and employers in Michigan.

Aetna Inc.

Aetna, a CVS Health company, is committed to helping people achieve their best health by providing innovative products and services that simplify the healthcare experience. With a strong focus on consumer-centric solutions, Aetna continues to be a leader in the global health insurance market.

AXA – Global Healthcare

AXA is a multinational insurance firm known for its strong presence in the global healthcare market. Through AXA Global Healthcare, the company offers a range of health insurance products and services designed to meet the diverse needs of expatriates, international students, and globally mobile individuals.

HBF Health Limited

HBF Health Limited is a leading health insurer in Australia, known for its commitment to providing high-quality, affordable health insurance options to its members. With a focus on customer satisfaction and community engagement, HBF Health Limited continues to be a trusted provider in the global health insurance landscape. The advantages of the health insurance plan of the company include higher annual limits for loyal members, unlimited urgent ambulance, stay in a private room, etc.

Centene Corporation

Centene Corporation is a diversified, multi-national healthcare enterprise that provides programs and services to government-sponsored healthcare programs, focusing on under-insured and uninsured individuals. With a mission to improve the health of the community, Centene Corporation plays a significant role in the global health insurance market. Centene’s diverse portfolio of health solutions reflects its commitment to the health of the children, families and individuals that it serves. Centene’s competitive advantage is driven by its capacity, capability, scale, and more than 30 years of experience in operating government-sponsored healthcare programs.

International Medical Group, Inc.

International Medical Group (IMG) specializes in providing global insurance benefits and assistance services to individuals, families, and groups worldwide. With a focus on delivering innovative solutions and exceptional customer service, IMG continues to be a prominent player in the global health insurance industry. As the leading provider of travel and health safety solutions, IMG offers an extensive array of insurance programs. These include international private medical insurance, travel medical insurance, and travel insurance. Additionally, the enterprise services encompass insurance administrative services and round-the-clock emergency medical, security, and travel assistance. IMG’s top-tier services, coupled with a comprehensive product portfolio, offer peace of mind to travelers, students, missionaries, marine crews, and other individuals or groups living, working, or traveling away from home.

Elevance Health, Inc.

Elevance Health is a technology-driven health insurance company that leverages data and analytics to deliver personalized healthcare solutions. With a focus on transparency and affordability, Elevance Health is reshaping the global health insurance market through its innovative approach to coverage and care delivery. The company serves people across their entire health journey and address their full range of needs with an integrated whole-health approach.

Allianz Care

Allianz Care is a leading international health insurer with a strong global presence. With a focus on customer-centricity and innovation, Allianz Care offers a range of health insurance products and services designed to meet the evolving needs of expatriates, travelers, and globally mobile individuals. The company provides digital or in-person support around the clock. The company offers a network of over 1.9 million quality medical providers, settling medical bills directly with the provider for most in-patient treatments. The company is financially strong with A+ Superior, A. M. Best rating. Its range of services includes tailored international healthcare plans catering to distinct regions, alongside offerings of short-term international health insurance and critical illness cover.

Conclusion:

The global health insurance industry is characterized by its diversity, complexity, and capacity for innovation. As the world grapples with ongoing health challenges and demographic changes, the role of insurers in promoting access to quality healthcare services remains indispensable. By embracing technological advancements, navigating regulatory complexities, and addressing emerging trends, insurers can adapt to evolving customer needs and contribute to a more inclusive and resilient global healthcare ecosystem.