Impact of Russia-Ukraine Conflict on the Global Economy

The stoking fears of Russia invading Ukraine, escalated by the build-up of tens of thousands of Russian troops on Ukraine’s borders since the past month, have been realized. On February 21, Russia’s President, Vladimir Putin launched “peacekeeping military troops” into two breakaway Ukrainian regions and announced them as independent states, which has created havoc on the already volatile Ukrainian economy. Russia has also signed two identical friendship treaties that grant it the right to build bases in the separatist regions, Donetsk and Luhansk in Ukraine. The executive order has imposed trade sanctions on the breakaway regions, forbidding any import/export, re-export, sale, or supply of goods, services, or technology into the United States. Besides, the order also prohibits Americans from making any investments in these regions. The geopolitical conflict between Russia and Ukraine has already started affecting the global financial markets and triggered a stock market sell-off.

The world economy and financial markets are interconnected, and instability arising out of the Ukraine invasion by Russia could lead to major consequences. Western powers have warned Putin of imposing serious sanctions and measures, which could kick Russia out of the vast swift network of financial messaging. Besides, western allies are deciding to ban banks from trading Russian corporate or sovereign debt, which could cripple the Russian economy. However, Russia has a strong financial backbone with some USD600 billion of foreign currency reserves, which could help the country to cushion the blow by western countries for a short term at least.

Higher Global Oil & Gas Prices

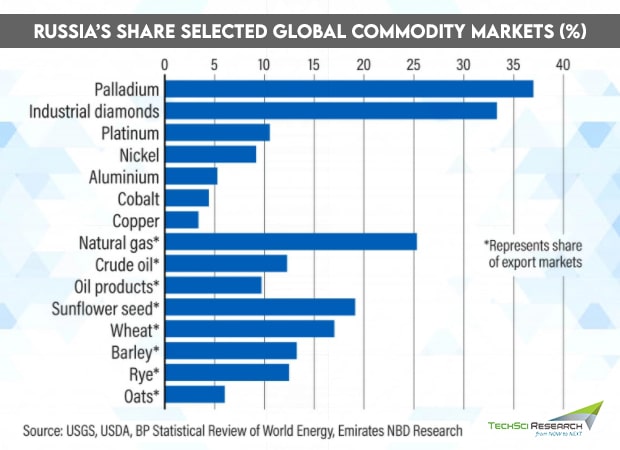

Russia is the third-largest oil producer in the world, accounting for approximately 13% share in global crude oil production. The country is the second-largest oil exporter after Saudi Arabia, so it is a major player when it comes to the prices of global oil prices. In 2021, Russian exports of oil were estimated to be over USD110.1 billion, registering 52% growth from the previous year. The oil prices are likely to be higher than what they already are (USD97/bbl) in the international market. After Russia invaded Ukraine, the price of crude oil escalated to levels close to USD100 per bbl and is expected to hit even USD115/bbl amidst tight global supplies and recovering fuel demand. The United States is vulnerable to oil price shocks as the country is a net importer of crude oil, majorly from Canada and the Middle East. However, Russia supplied 10% of the total US oil imports in 2021 as it boycotted oil from Venezuela. The world economy hit by the COVID-19 pandemic had been recovering slowly, but the Ukraine-Russia conflict could pause the significant growth. Oil prices reaching USD150 a barrel could reduce global economic growth by more than three quarters in the first half of 2022.

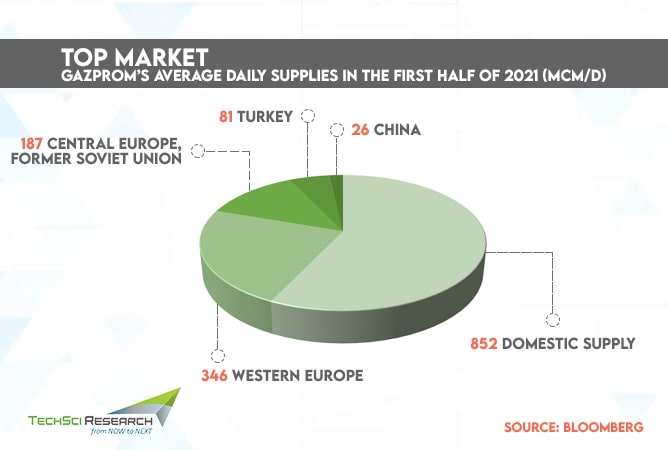

Russia is the second-largest producer of natural gas after the United States and the largest natural gas exporter in the world, shipping 196 billion cubic meters of natural gas every year. Europe’s 40% of its natural gas supplies are fulfilled by Russia, and the continent has been unable to reduce its dependency due to its transition to clean energy, away from dirtier coal. Measures against Russia could reduce the supply of crude oil and natural gas in the global market, which could lead to substantial implications, pushing oil and gas prices inexorably. Germany, one of the largest importers of natural gas from Russia, has scrapped plans for a highly controversial undersea pipeline that would carry the natural gas from Russia to Europe, which could deprive Ukraine of billions in gas transit fees.

Food Inflation

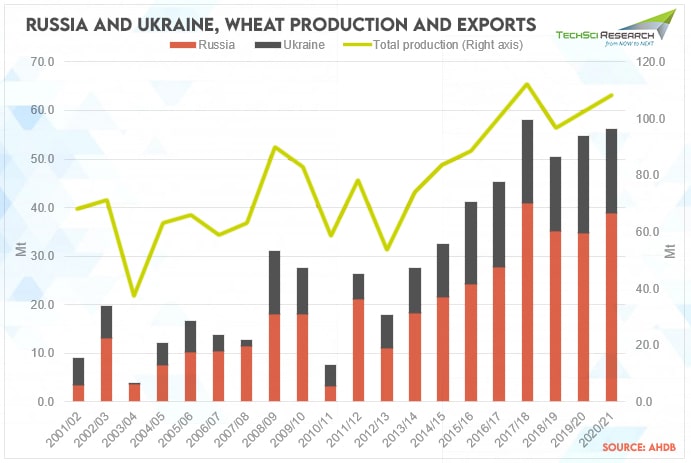

Russia is the world’s biggest wheat producer and a key supplier to the Middle East and European nations. Ukraine and Russia account for approximately 29% of the global wheat export market. The combined wheat exports for 2021-2022 are estimated to account for approximately 23% of the global total of 206.8 million mt., according to the US Department of Agriculture. Ukraine is the “breadbasket of Europe,” and a large-scale invasion of Russia on Ukraine could significantly impact the international food supply chain. The rising tensions in both regions have created volatility in the global wheat markets due to concerns regarding a decline in the supply of wheat from the Black Sea region. Ukraine is the biggest producer of corn, and the country also produces wheat, barley, and rye, which are exported in large amounts to other countries. The prolonged conflict between Russia and Ukraine could lead to bread shortages in the Middle East and Africa as they rely on Ukrainian wheat and corn. Food inflation has been rising already, and Russia’s seizure of agriculture-rich lands in Ukraine would only escalate the food prices. Besides, disruptions in natural gas supplies would affect the overall energy-intensive products such as fertilizers, pesticides, etc., used for harvesting.

Rising Prices for Metal Products

Russia’s invasion of Ukraine could have a significant impact on the price of precious metals, which have escalated by 215% in the past five years. Ukraine is a huge supplier of uranium, titanium, iron ore, steel, and ammonia. The country accounts for 10% of Europe’s steel imports. Russia is the biggest exporter of palladium and platinum, which are mostly used metals by automotive manufacturers. Hence, auto companies around the world would be impacted severely by the tight supply chain of the metals, which could make the cars expensive. The automotive industries around the world are already facing severe microchip shortages, and the expanding supply chain problems could further elevate problems. Many manufacturing hubs for brands like Stallantis, Volkswagen, and Toyota are based in Russia, and they could struggle to operate under sanctions, which could hamper production and availability of vehicles. Russia-based Rusal is one of the largest producers of aluminum, whose production totaled around 3.76 million mt in 2021, most of which goes to Europe. The aluminum prices have already reached a record high, and fears mounting those sanctions could further tighten the supply chain. Besides, Russia produced 920,000 tons of refined copper, which accounted for 3.5% of the global output in 2021. Asia and Europe are the major export markets for Russia, but the conflict could lead to higher copper prices globally, which could largely affect industries around the world.

Rise in Cyberattacks

Cyberattacks are a part of Russia’s military strategy against Ukraine to destabilize its government and economy. However, cyberattacks might spread to other countries as well, including the US. Russian intelligence services have initiated many cyberattacks against Ukraine in the last months. Russia is home to some of the most notorious criminal hackers, and most of them are state-sponsored. With the rising risks for cyberattacks, Western companies and agencies ensure that their systems are patched against the known vulnerabilities. The UK’s National Cyber Security Center are bolstering their online defenses, observing the historical patterns of cyberattacks on Ukraine with international consequences. The 2017 NotPetya cyberattack ordered by Moscow on Ukrainian private companies spilled over and destroyed systems around the world incapacitated shipping ports and left organizations unable to function. Considered to be the most destructive cyberattack, NotPetya caused more than USD10 billion in global damage. Russia has demonstrated time and again that they are capable of developing some of the most complex and aggressive cyberattacks aimed at destabilizing or diversifying adversaries. Russia has the capability to destroy US satellites, which could impact GPS for navigation, automation, oil exploration, and farming. Thus, systems around the world need to build resilience against potential cyberattacks, which could disrupt the economy and threaten national security.

Stock Market Volatility

The effect of conflict between Russia and Ukraine has been disastrous on the stock market. The ongoing crisis is expected to contribute to increased short-term market volatility, which is creating concerns for investors. Russia’s economy ranks as the world’s 11th largest, and its contribution to the global economy is not big enough to affect the international markets by large. However, Russia contributes to 10% of world’s energy, 50% of which is provided to the European Union. Hence, a spike in energy prices would impact every asset class. Amidst the geopolitical turmoil, oil and safe-haven assets are being appreciated while equities and currencies have come under pressure. The turbulence in the market could put a dent in the portfolios of investors for the short term, but its psychological effect could erode consumer confidence and curb spending. Meanwhile, major cryptocurrencies have also witnessed a major slump as the Russia-Ukraine crisis boiled over. Hence, investors are increasingly transitioning towards safer havens like dollars and gold amidst the turmoil.

Conclusion

The Central Banks are already struggling in an already-hot inflammation market, and the risk of stagflation is higher than ever. If inflation rates spike above 10%, the Federal Reserves could increase their borrowing costs for consumers. This would mean high lending rates for everything, from credit cards, car loans, and mortgages, which could present a new challenge for consumers. As the Russia-Ukraine situation intensifies, the Fed’s might not be able to handle the inflation without sparking a recession. This could give a huge blow to the economy, which is still recovering from the COVID-19 pandemic.