DOTP Plasticizer: Next Move in Plasticizer Industry

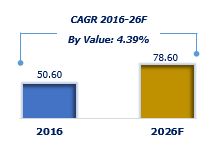

The demand for plastic additives is showcasing a boisterous growth on account of burgeoning demand for plastic products around the globe. The global consumption of plastic additives amounted to more than 30 million metric tones during 2016 and is expected to rise prodigiously owing to the growing replacement of wood and metal with safe, reliable, light, and cheap plastics. Major end user industries including automotive, electrical & electronics, construction, packaging, medical, consumer durables, etc. are supporting the transition from metal to low cost plastic substitutes, which in turn is aggressively driving the demand for several plastic additives such as fillers, plasticizers, pigments and many others.

Global Plastic Additives Market, By Value, 2016 & 2026F (USD Billion)

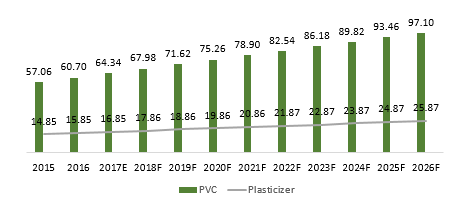

In 2016, the plasticizers accounted as the second largest consumed plastic additive owing to their ability to enhance properties of polymer and rubber in terms of flexibility and durability. During 2012-16, the PVC industry remained a major contributor to the global plasticizers market and would continue to maintain its dominance through 2026 as well. With the robust growth in automotive sector, increasing middle-income population and infrastructure developments, the applications of PVC in cable jacketing, floors & wall coverings, coated fabrics, films & sheets, wires & cables, window frames & shutters, pipes & fittings, bottles & containers, luggage, sports equipment, footwear, tablecloths, stationery, roofing membranes, hoses & profiles and several others are demonstrating exemplary growth during the forecast period, thereby generating huge market opportunities for plasticizer manufacturers.

Global PVC and Plasticizers Market, By Value, 2015-2026F (USD Billion)

Source: TechSci Research Estimates

Plasticizers are basically segmented into phthalates and non-phthalates, wherein phthalate plasticizers garnered more than 60% value share in the global plasticizer market during 2016. However, the penetration of plasticizers in the non-phthalates segment is anticipated to grow at a notable pace on account of the looming regulatory changes. Increasing environmental and health concerns associated with the exposure has led to strict ban of certain phthalate plasticizers across European and North American nations. For instance;

- The European Parliament as well as United States Consumer Product Safety Commission (CPSC) have banned six types of phthalates: DEHP, DBP, BBP (Permanent Ban), DINP, DIDP, and DnOP (Interim Ban) in any amount greater than 0.1% for usage in:

- Children’s toys,

- Any child care article that is designed or intended by the manufacturer to facilitate sleep or the feeding of children age 3 and younger, or to help children age 3 and younger with sucking or teething.

- Any children’s toy that can be placed in a child’s mouth (Specific to interim banned Phthalates)

Amidst the ongoing ban over the usage of traditional phthalate plasticizers, the non-ortho-phthalates as a general-purpose plasticizer is gaining the attention of manufacturers worldwide. DOTP or Dioctyl Terephthalate is emerging as a fastest growing plasticizer owing to its excellent toxicological profile. DOTP is a direct replacement for DOP & DINP in many applications due its low volatility and various other superior functional attributes, such as thermal resistance, excellent durability and high transparency. Growing applications in extrusion calendaring, injection & rotational molding, dip molding slush molding, inks & coatings, etc. is facilitating the growth in Global DOTP Plasticizers market.

The global Dioctyl Terephthalate (DOTP) Plasticizer market accounted for total consumption of more than 1 million metric tons during 2016, which is expected to exhibit agile growth through 2026. Robust growth is expected in the global DOTP Plasticizer market as it is projected to grow at a CAGR of more than 10% in value terms, during the forecast period. As phthalates are increasingly identified as the substances of very high concern (SVHCs) for their endocrine disrupting properties for human health and the environment, the preference for DOTP plasticizers is growing in sensitive applications requiring close human contact such as food packaging, medical equipment & devices, personal care products and toys, thereby stimulating the global DOTP plasticizer market at a rapid pace.

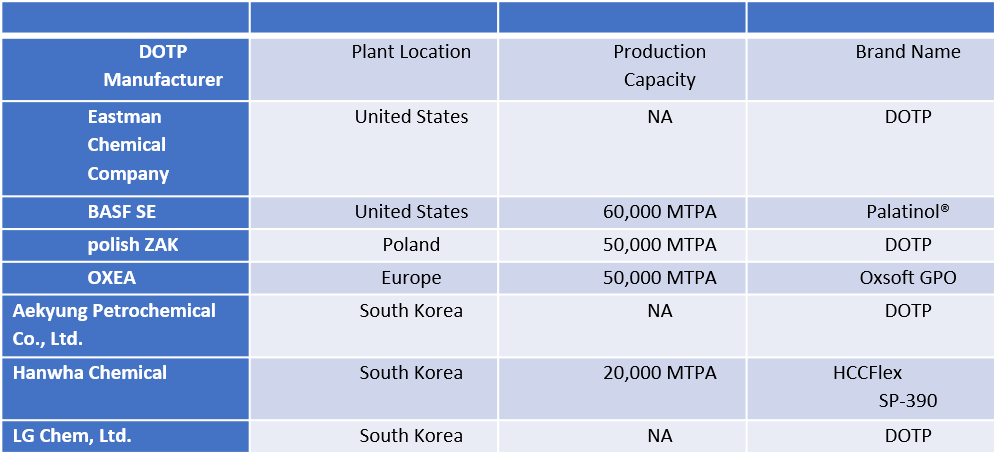

Partial List of DOTP Manufacturers operating Globally

Source: TechSci Research

Source: TechSci Research

The growing realization of benefits from environment friendly phthalate free DOTP plasticizer has hastened the import activity in United States as companies including ALAC International, Inc. (New York), Chembank International, Inc. (Closter, NJ), Greenchem Industries, LLC (West Palm Beach, FL), ICC Chemical (New York), Innua USA Inc. (Wilmington, DE), MC International, LLC DBA Miami Chemical (Miami, FL), Mexichem Specialty Compounds Inc. (Leominster, MA), Soyventis North America LLC (Jersey City, NJ), Tricon International Ltd. (DBA Tricon Energy Ltd.) (Houston, TX), Univar USA Inc. (Downers Grove, IL) registered as top importers of DOTP plasticizers over the past five years.