NFC Payments through Smartphone to Replace your Credit Cards

For years, credit cards and debit cards have remained the most popular way of conducting transactions. In 2020, cash, debit card, and credit card payments accounted for approximately 19%, 28%, and 27% of the total number of transactions made by the US consumers, according to the 2021 findings from the Diary of Consumer Payment Choice. However, with the advancements in technology and increased smartphone adoption, contactless payments are gradually gaining popularity.

According to MasterCard Consumer Polling, 51% of Americans are now using some form of touch-free payment method rather than paying with card or cash since the COVID-19 pandemic began. Although digital wallets marked their entry much before the pandemic, the consumer adoption of contactless payments was slow. However, the pandemic created a demand for the adoption of more hygienic, touch-free payment alternatives to prevent the spread of virus.

The contactless payments are mainly driven by two technologies, NFC (Near Field Communication) and QR (Quick Response) code. The NFC payment method requires customers to make the transaction with a payment device embedded with a chip, which can be a smartphone, a wearable device, or a smartwatch. The payment device used during the transaction process at the point-of-sale (POS) terminal must have radio frequency identification (RFID) technology enabled in them. The customer just has to tap or wave his/her payment device over the POS terminal in close proximity to the POS terminal to allow data sharing through several layers of authentication for making the payment. NFC technology can be used in three ways, such as peer-to-peer, read/write, and card emulation.

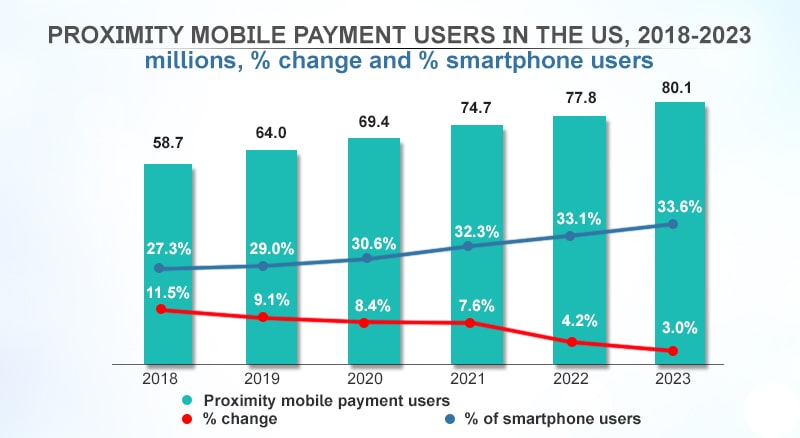

As per estimates, around 72 million people were already using NFC payments in 2019, which increased to 29% Y-o-Y to 92.3 million in 2020. The user base of proximity mobile payments is anticipated to surpass 100 million in 2021 and almost half of the smartphone users in the US by 2025. Although contactless payments exploded in popularity due to being the “cleaner method to pay” during the pandemic, now they are being used for enhanced convenience, reward points, discounts, and expanded availability.

According to a survey, 72% of Americans use contactless credit cards to skip signature and make secure payments. Contactless credit cards are much secure than magnetic-stripe cards that are easy to clone, hack, and vulnerable to fraudulent charges and identity theft. Whereas data associated with contactless cards is completely encrypted and secured with biometric identification or pin, which makes it difficult for fraudsters to hack a system. Besides, even if your smartphone is stolen, the thieves could not get access to your virtual credit cards stored in your app.

According to estimates, the volume of transactions made through mobile wallets has been increasing at a rapid rate. Till 2020, more than USD182 billion were transacted in-store, USD30 million more than the previous estimate. In 2021, the transaction value has jumped to nearly UD250 billion and is expected to reach USD500 billion by 2025. With major US retailers rolling out contactless acceptance, USA is anticipated to see the growth of transaction value to almost 300% in the next five years.

Given the increasing inclination of consumers towards contactless payment methods, fintech companies would continue to invest their resources in developing new contactless solutions that are secure and convenient. Digital native generations like millennials and Gen Z are quick to adopt the latest technological innovations and are likely to avoid shopping from stores that do not offer contactless payments. The Millennial and Gen Z population is expected to constitute the majority of mobile proximity payment users, collectively making up for 68.9% of users in 2021 and 71.4% by 2025. However, even boomers are rapidly shifting to mobile wallets and contactless credit cards for making transactions rather than carrying cash or physical cards.

As per estimates, smartphone usage in the US surged to an average of 182 minutes every day from 154 minutes pre-pandemic, which extended to making transactions via mobile wallets. With increased smartphone adoption in the US and more brands actively promoting contactless payments, competition among major mobile wallet providers has intensified. As per the recent report by Juniper Research, payment providers like Apple Pay, Samsung Pay, and Huawei Pay are likely to triple in value and reach the market value of USD1 trillion in 2024. Major mobile payment providers such as Apple Pay, Google Wallet, PayPal Mobile, Square Order, GoPayment, Paydiant, Visa Checkout, MasterCard Master Pass, etc. are increasingly building full-suite mobile payment products to capture a share of the projected trillion-dollar market and gain a competitive advantage over their competitors. Apple Pay remains the top mobile payment player in the US with over 44 million users, which is anticipated to grow by 14.4 million by 2025.

Offering new features in the mobile payment services to generate loyalty and providing incentives to win over non-adopters are ultimately helping to broaden the scope of NFC-based mobile wallets’ user base in the US. Besides, the introduction of flurry mobile wallets by big retail chains like Dunkin Donuts, Starbucks, Walmart, and others are further endorsing the use of mobile wallets across consumers and shifting consumer preferences.

Mobile point-of-sale (mPOS) is gaining traction as it requires a mobile phone enabled with near-field communication (NFC), which is further used as a POS terminal for payment processing. Opposed to a traditional fixed terminal, smartphones enable businesses to accept card payments where they previously could not and help retailers operate their business through mobile.

What’s Better-EMV cards or NFC cards?

EMV (EuroPay, Mastercard, Visa) cards consist of a tiny computer chip with more sophisticated encrypted security features. These cards are dipped instead of magstripe cards that are swiped. Whereas NFC cards are embedded with RFID (Radio Frequency Identification) technology that enables customers to “tap to pay” instead of being inserted into payments reader. While EMV cards need to be physically present with the consumer at the time of transaction, NFC cards can be accessed through smartphones.

Many new terminals accept both NFC and EMV payments, but some machines can only take one or the other. For instance, Square has a mobile credit card reader capable of accepting either magnetic stripe cards or EMV cards, but not NFC payments. However, both EMV and NFC cards are secure than the unencrypted magnetic strip cards. Businesses that do not have EMV compliant machines are liable for fraudulent transactions, but there are no repercussions as such for businesses not accepting NFC payments.

Is Buy Now, Pay Later (BNPL) Consumer Financing the Future of Credit Cards?

More than 45 million Americans are expected to use “Buy Now, Pay Later” finance services, 81% up from 2020, according to a forecast by eMarketer. Millennials and Gen Zers are quick to adapt BNPL to borrow money to buy goods which is an interest-free option, rather than using the traditional credit card that accrues interest if the cardholder fails to pay their due on time. As per Worldpay, around 1.6% of US e-commerce involves BNPL plans, and the share is anticipated to grow to 4.5% by 2024.

Earlier, BNPL was limited to online purchases, but now the financing option is available in stores and has become a popular payment option for purchasing electronics, clothing, appliances, furniture, etc. Even consumers are favoring those merchants that accept BNPL. Merchants have to pay BNPL firm fees of 4-5%, which is 2% higher than what they pay to credit card companies, but they are willing to do that to grab new customers and close sales that might not happen. As per a survey conducted by the National Retail Federation and Forrester, 67% of retailers now accept some form of no-touch payments, including both mobile payments and contactless cards. However, credit card companies are not likely to lose their best customers to BNPL finance services as more affluent ones prefer racking up points in loyalty/reward programs with big purchases.

Challenges

Only seven out of ten Americans have access to credit cards while 8.4 million households have no bank account. Thus, contactless payment is only advantageous for those who can actually afford it. Thus, cash is expected to remain the primary medium of making transactions over cards or contactless payments. Besides, other factors that could limit the use of NFC payments are the unavailability of smartphones or inadequate POS terminal infrastructure at the retail stores to facilitate contactless transactions.

Conclusion

While convenience and eliminating the need to carry cash has been the driving factor behind cashless payment methods, the cashless movement is only growing. The advent of the worldwide pandemic increased the demand for enhanced alternatives and now the transition to virtual credit and debit cards are eliminating the need to keep cash on hand. The use of third-party services and applications like PayPal, Apple Pay, etc., are more likely to become a tech-savvy population. Besides, the increase in digital currencies and fintech cryptocurrencies will gradually replace hard cash as payment for goods and services, but it will take some time to become a reality.