What does India have in Store for Phosphatic Fertilizers?

Product Overview:

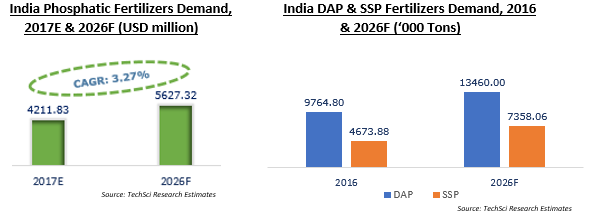

The Phosphatic Fertilizers, as the name suggests refers to the class of mineral fertilizers which are rich in the nutrient phosphorus. Based on amount of phosphorus pentoxide, P2O5 present in the chemical structure, the phosphatic fertilizers can be divided into Single Super Phosphate (SSP), Monoammonium Phosphate (MAP), Diammonium Phosphate (DAP), Triple Super Phosphate (TSP) along with certain other complex fertilizers. The increasing awareness among the farmers about the importance of soil quality, slight increment in the prices of few crops and the plummeting prices of DAP in the country are poised to propel the India Phosphatic Fertilizers Market over the coming years.

Top Industry News:

From 2017-

- Deepak Fertilizers & Petrochemicals Corp. Ltd. spent INR800 Crores to initiate the commercial production of novel grades of NPK fertilizers branded as `Mahadhan’ for domestic customers.

- Coromandel International received green light for the INR225 Crore business expansion project entailing the elevation of phosphoric acid production capacity from 700 TPA to 1,000 TPA in Andhra Pradesh, targeting almost 3,900 TPD production of complex fertilizer in Vishakhapatnam.

From Last Year-

- Krishak Bharati Cooperative Ltd. joined hands with the OCP Group to build and construct a phosphatic fertilizer factory in Andhra Pradesh by spending INR1,500 Crore.

- Rashtriya Chemicals and Fertilizers in collaboration with the National Mineral Development Corporation prospected opportunities to establish DAP producing facility in Algeria, North Africa.

To request the sample report, please visit: https://www.techsciresearch.com/report/india-phosphatic-fertilizer-market/1337.html

Let’s not Forget to Consider the Falling Prices of Raw Materials:

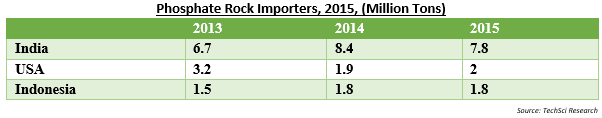

The prices of DAP have declined across the world from USD400 per ton to USD350 per ton which is propelling Indian fertilizer manufacturing companies to import phosphoric acid at USD600 per ton to produce NPK and DAP fertilizers. The country’s annual requirement of phosphoric acid is ~26-27 lakh per ton, which is majorly utilized for producing DAP. As DAP is the 2nd most commonly used fertilizer after Urea, the step is going to bolster consumption in Phosphatic Fertilizers in India.

Get Ready to Face the Challenges Ahead in the India Phosphatic Fertilizers Market:

Under the goods & services tax regime, India recently revised tax rates from 4-8% to 12% on fertilizers which is expected to pose hurdles in the growth of phosphatic fertilizers in India. The retail prices of Non-Urea fertilizers such as DAP may expect a hike of INR3,000 per Ton in states including Punjab, Haryana and Uttar Pradesh. The top crop producing Indian states which were earlier dispensed from all kinds of taxes on farm nutrients are expected to raise the MSP on DAP by almost 10%, which is anticipated to hinder the consumption of phosphatic fertilizers in India, through 2026.

Conclusion:

In conclusion, the India Phosphatic Fertilizer market stood at nearly USD15 Million during 2016 and is expected to showcase growth at a CAGR of 3.6%, exceeding USD20 Million by the end of 2026. Owing to the falling prices of phosphate inputs such as phosphoric acid, rock phosphate, etc., the demand for phosphatic fertilizers is increasing steadily in the country. In addition to this, the rising concerns and focus on the soil health is driving wide adoption of phosphatic fertilizers among the Indian farmers. Moreover, various initiatives by government such as India’s subsidy policy aimed at improving the purchasing power of fertilizers would escalate the overall consumption of phosphatic fertilizers in the country through 2026.