Impact of Ford’s Exit on Indian Automotive Industry Market Share

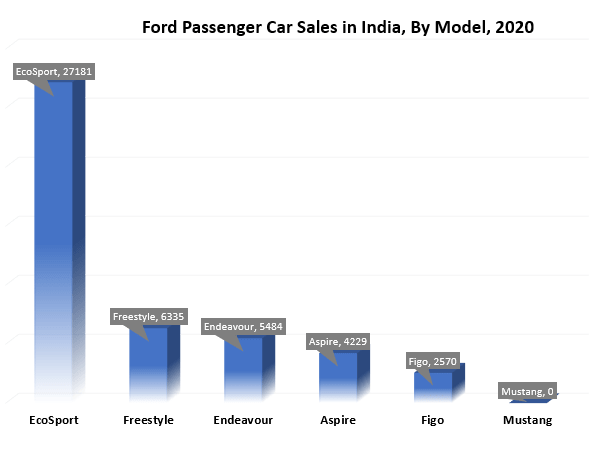

Ford Motor Company has decided to exit from the Indian automotive industry and cease the production of cars in its manufacturing units located at Maraimalai Nagar and Sanand. Ford will stop manufacturing the vehicle for export purposes in Sanand, Gujarat by the fourth quarter of FY2021 as well as engine and vehicle manufacturing in Maraimalai Nagar, Chennai by the second quarter of FY2022. Ford Motor Company sells five models in India – Freestyle, EcoSport, Aspire, Figo, and Endeavour. Its exit is expected to put a massive dent in the Indian automotive industry. Before Ford, two other US-based automaker Harley Davidson and GM, have exited the India due to low sales and profit margins in the past. The sale of all the present current car models will stop after the dealer’s stock gets over.

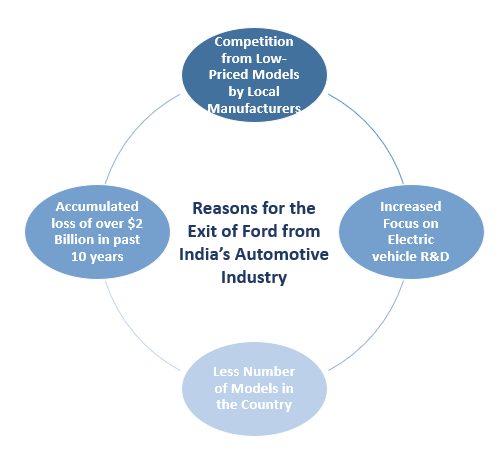

The accumulation of more than $2 billion operational losses in the past 10 years, and a $0.8 billion non-operating write-down assets of 2019 alone, the American automobile company is forced to exit from the Indian market. Ford’s production capacity dropped down to 25% of total capacity and incurred huge losses, which is one of the main reasons for the company’s exit from the country. The partnership deal with Mahindra & Mahindra was not successful which adversely affected the market position of the country.

“The move is anticipated to adversely impact the 4,000 employees working in Ford Motor Company directly and around 170 dealers who had already made investments of around ₹2,000 crores and employed 40,000 people and have around 391 outlets”, said Federation of Automobile Dealers Associations (FADA). The automotive company is expected to take a hit of around $2 billion and blamed the decision of moving out from the country due to lack of profitability. Ford company struggled to gain more customers of the passenger vehicle and holds less than 2% of the market share. “The decision was reinforced by years of accumulated losses, persistent industry overcapacity and lack of expected growth in India’s car market,” said Anurag Mehrotra, President and MD at Ford India.

The Ford Motor Company has promised to provide the customers with the availability of aftermarket parts and warranty support services by the company. Ford company will continue operating from select outlets in India to maintain its presence in India. The automaker company is going to sell its most exclusive cars, like, Mustang Coupe, Mustang Mach-E electric through the import route. The company is planning to expand the business in India, by exporting the CBU and CKU units rather than indigenously manufacturing the vehicle. Ford is going to deliver electric and hybrid vehicles and will work closely with its dealer networks to ensure maximum consumer satisfaction and efficient aftersales service.

Lakhs of people rely on the service and quality of prestigious company Ford and the concerned officials have stated that they would try and provide the best customer support operation to maintain the confidence and trust customers have showered for the last 25 years. Jam Farley, President, and CEO at Ford Motor Company emphasized the fact that customers are their utmost priority and stated, “I want to be clear that Ford will continue taking care of our valued customers in India, working closely with Ford India’s dealers, all of whom have supported the company for a long time.”

With the entry of new players in India such as MG Motor and Kia Motor, and the aim to achieve the BS-VI norms, the sales of Ford Motor Company were put in a tight spot. With the shortage of the global semiconductor market and the occurrence of the COVID-19 pandemic, the Ford Motor Company was left with no choice but to leave the automotive industry of India. Ford’s decision is also expected to negatively impact the “Make in India” campaign, and it follows the exit decision of other renowned automotive industry players in India like Harley Davidson, Man Trucks, UM Lohia, and General Motors.

Ford’s Position in Indian Passenger Car Market

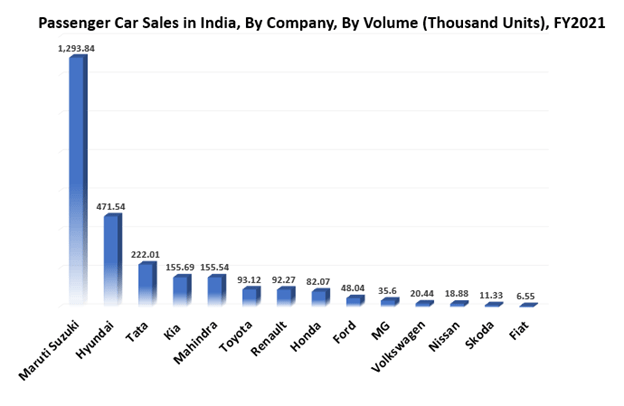

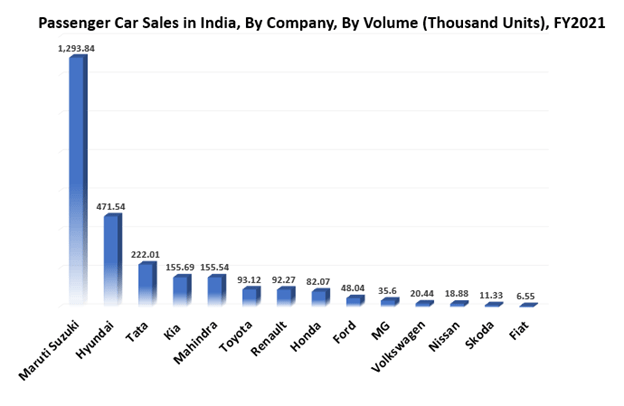

0India passenger car market registered 2.71 million sales in FY2021, down from 2.77 million sales in FY2020. Reason for slight drop in sales can be attributed to backlog & long pending orders due to shortage of semiconductor and fear of COVID-19 third wave. In FY2021, Ford captured 1.77% share of passenger car market which converted to 48.04 thousand sold units.

However, in FY2022, market share of Ford further dropped. In August 2021, the company sold 1508 cars in comparison to 4731 sold in August 2020, making its market share close to 0.6% in August, 2021.

According to Techsci Research on “India Passenger Car Market By Vehicle Type (Hatchback, Sedan, SUV and MPV), By Fuel Type (Petrol and Diesel), By Transmission Type (Automatic and Manual), By Engine Capacity Type (<1000, 1000-1500, 1500-2000 and >2000), By Segment Type (Mini, Compact, Micro, C1, C2, D, E and F), By Region, Competition, Forecast & Opportunities, 2026”, the passenger car market in India is projected to grow at a CAGR of over 10% in the next five years. Increasing disposable income and growing number of low-priced car models are anticipated to fuel the growth of the market through FY2026.

Following departure of Ford from the automotive industry, it would be interesting to see which automaker benefits and captures the market share:

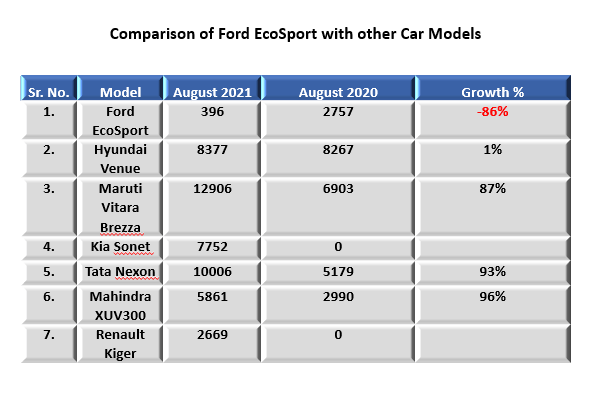

· Ford EcoSport:

The Ford EcoSport is one of most selling compact SUVs of Ford, registering sales of 27181 units in 2020. The SUV is available in a variety of engine-transmission combinations. Major competitior of Ford EcoSport in the Indian automotive market are Hyundai Venue, Maruti Vitara Brezza, Kia Sonet, Tata Nexon, Mahindra XUV300, Nissan Magnite, Renault Kiger, and Toyota Urban Cruiser. In comparison of sales Maruti Vitara Brezza, Tata Nexon and Mahindra XUV300 are expected to benefit most from the departure of Ford EcoSport. All three models registered growth of over 85% in August 2021 in comparison to August 2020. Due to wider service network and more powerful engine, Tata Nexon is expected to witness increased sales in the upcoming months.

Following Tata Nexon, Maruti Vitara Brezza is expected to benefit most from the departure of Ford. Brezza is already the largest best-selling compact SUV in August even when it is available with a petrol engine variant only. Maruti Vitara Brezza has sold 12906 in August 2021 which is 87% high from August 2020. Maruti Vitara Brezza consists of 1.5-litre K15 engine that can produce 103 bhp and 138Nm of peak torque. It also offers innovative features such as steering-mounted controls, automatic headlamps, Smartplay studio, Apple CarPlay, key-less entry, and automatic climate control system, among others which ensures maximum comfort and protection of customers.

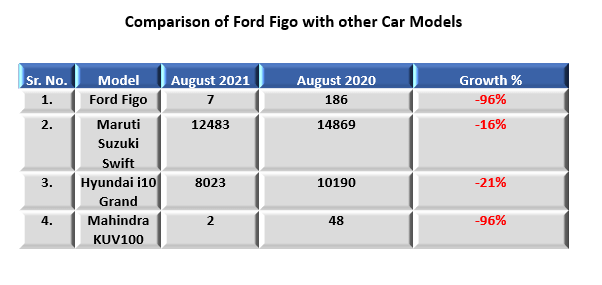

· Ford Figo:

The Ford Figo is available in four petrol and three diesel variants with three engine options and 10 colors. The Ford Figo major rivals are Maruti Suzuki Swift, Hyundai Grand i10 Nios, and Mahindra KUV100NXT and are about to be the maximum benefitted from the departure of the Ford Figo model from the Indian automotive market. The Maruti Suzuki Swift is expected to gain maximum profit from the departure of the Ford Figo as it offers more variants across a wider price range. Maruti Suzuki Swift already sold more than 1.60 lakh units in the previous year. Maruti Suzuki Swift also boasts of attractive innovative features like LED headlamps, touchscreen infotainment system, climate control and multiple designs for the black interiors and for alloy wheels. Hyundai Grand i10 Nios sales are also expected to gain momentum after the stoppage of sales of Ford Figo in the country. Premium interiors along with the presence of an upgraded engine following the BS-VI norms is working in the favor of the Hyundai Grand i10 Nios.

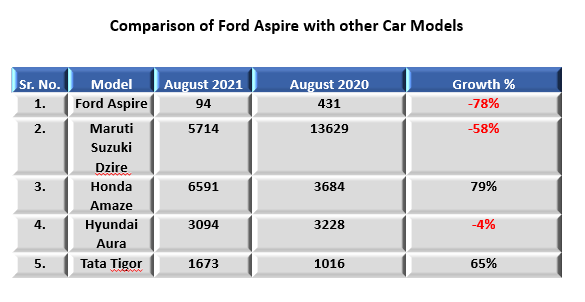

· Ford Aspire:

Ford launched the Figo-based compact sedan Ford Aspire to attract more customers. The competitors of the Ford Aspire in the Indian automotive market are Maruti Suzuki Dzire, Honda Amaze, Hyundai Aura, Tata Tigor, and these are considered some of the best-selling compact sedans in the market of India. The Maruti Suzuki Desire model followed close by Honda Amaze is expected to witness impressive growth owing to the exit of the Ford Aspire from the Indian market. The Maruti Suzuki Dzire offers their customer outstanding customer service, fuel efficiency, and comfortable seating for three people in the back of the car. The Maruti Suzuki Dzire has already sold around 1.28 lakh units in the year FY2021. Honda Amaze boasts of an efficient engine with a spacious cabin and is expected to attract a lot of potential customers.

· Ford Freestyle:

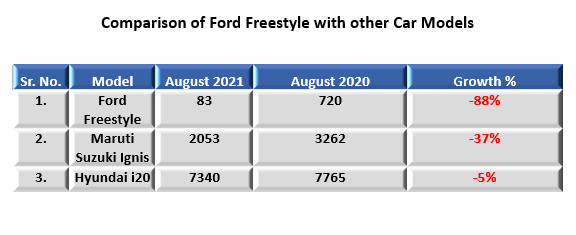

The Ford Freestyle is a crossover hatchback and is available in six engine variants with two engine options. The Ford Freestyle engine makes 95 bhp of peak power and 120 Nm of torque with 1.5 litres The major rivals of Ford Freestyle in the Indian market were Maruti Suzuki Ignis, Toyota Etios Cross, new Hyundai i20. The Ford Freestyle sold more than 6000 units in the last year. The Maruti Suzuki Ignis is affordable for the customers and has already sold more than 2000 units in the month of August 2021. The Maruti Suzuki Ignis sales are expected to witness huge growth for the departure of the Ford Motor Company from the Indian automotive market. Hyundai i20 and Honda WR-V are both premium segment cross-hatchbacks and are expected to be benefitted after the discontinuance of the Ford Freestyle car model.

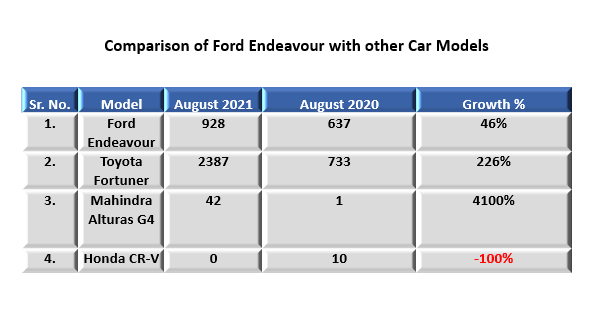

· Ford Endeavour:The Ford Endeavour competitors present in the Indian market were Toyota Fortuner, Mahindra Alturas G4, Honda CR-V, and Skoda Kodiaq. Toyota Fortuner is the biggest rival of the Ford Endeavour in India and with the closure of manufacturing facilities in India, Toyota Fortuner is expected to witness impressive demand. Toyota Fortuner is available with manual and automatic transmission methods and has a seating capacity of 7 persons. In the month of August 2021, with the presence of Ford Endeavour in the market who sold around 928 units, Toyota Fortuner has sold about 2387 units. In the absence of the Ford Endeavour, the Toyota Fortuner is expected to witness significant demand among the customers.