Green Hydrogen: Energy for the Future

The transition from fossil fuels to clean energy sources for reducing the emission of greenhouse gases are leading to the emergence of promising alternatives, one of them being Green Hydrogen. Green hydrogen, which uses renewable energy to produce hydrogen from water, has the potential to decarbonize hard-to-electrify sectors of the economy. Hydrogen is the most abundant and light-weight element found on the earth but producing the gas is a fossil fuel-intensive endeavour. According to the International Energy Agency (IEA), the world needs to produce approx. 306 million tons of green hydrogen every year to meet the net-zero emission target by 2050. Currently, nearly 87 million tons of all types of hydrogen enters the market.

Green hydrogen is produced by splitting water molecules into hydrogen and oxygen using electricity, sourced from onsite solar or wind energy. Electrolysis requires more energy than it produces in terms of hydrogen fuel, hence leveraging electricity derived from non-renewable sources will not create any new energy in a system and disorders will increase. Producing hydrogen through clean energy sources will help to meet global energy demands and contribute towards climate action goals.

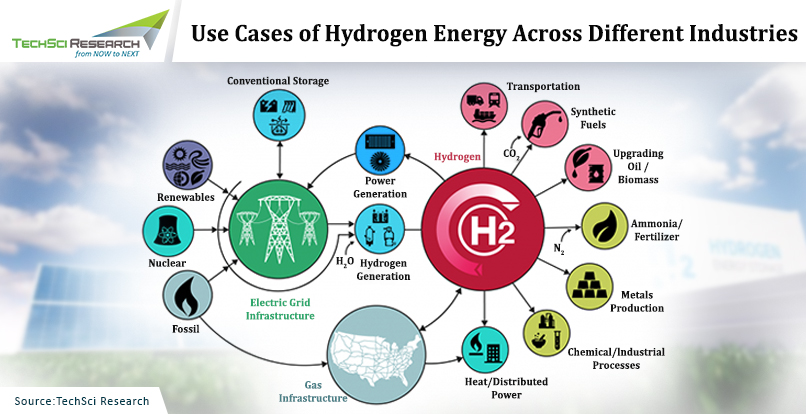

The hydrogen production from 2020 to 2021 was valued at USD130 billion and is projected to grow at a CAGR of 9.2% by 2030. Currently, 4% of hydrogen is generated through electrolysis for which 6% global natural gas and 2% global coal is utilized. However, with increased investments in green hydrogen production and expanding possible use cases for hydrogen across various industries, the global green hydrogen market is projected to grow significantly in coming years.

Unlike grey hydrogen that utilizes renewable electricity to power electrolysis, green hydrogen does not require fossil fuels. Hence, green hydrogen is a better long-term solution to help decarbonize economies. The most attractive production markets for green hydrogen are the places where solar and wind energy sources are available in abundance. Reducing the production costs due to continuously falling renewable energy costs, the green hydrogen will become more accessible and economical.

Rising Investments for Green Hydrogen Production Globally

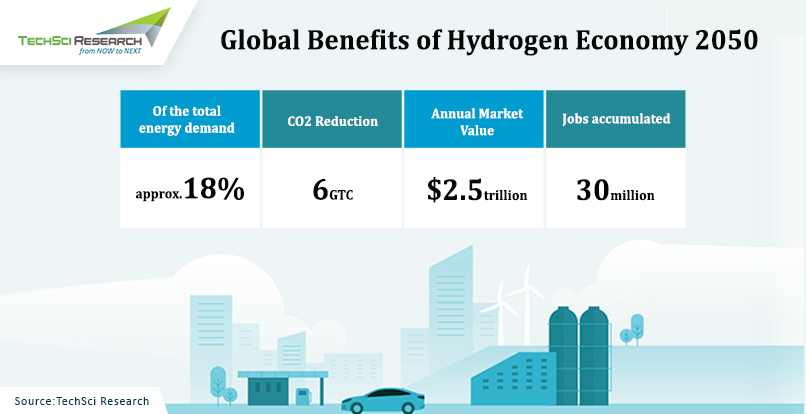

Global hydrogen economy can bring significant shifts in the geoeconomic and geopolitical shifts, changing the geography of energy trade and regionalizing energy relations. Recent geopolitical turmoil between Russia and Ukraine has led to gas price instability, which has highlighted the importance to discover more energy alternatives and increase self-reliance. Countries such as US, Canada, Russia, China, India, and Australia have regions for competitive and non-competitive hydrogen production, similar to current oil and gas hubs.

Leading industrial gas manufacturer, Air Products has collaborated with energy firm AES to build the largest hydrogen facility in the United States, which is scheduled to open in 2027. The complex is expected to include water electrolysers, which would be powered by 1.4 GW of wind and solar power facilities. The project can help to circumvent more than 50 million tons of carbon emissions, eliminating the use of conventional natural gas-based hydrogen production. The US government is also providing impetus to boost the green hydrogen energy production in the country, introducing a program to fund the development of regional hydrogen hubs. Hence, investment in clean hydrogen—backed by aggressive government subsidies—are expected to increase significantly.

As per predictions, green hydrogen energy could sustainably industrialize and boost GDP by 6-12% in six African countries, Egypt, Kenya, Mauritania, Morocco, Namibia, and South Africa. Having high potential for wind and solar energy, these countries are well-positioned to produce low-cost green hydrogen. This would help meet the domestic demand for hard to abate applications such as heavy industry, off-road transportation, in addition to growing market exports. Besides, growing investments in green hydrogen could help create millions of jobs and spur the creation of new industries such as green steel and fertilizers. Collective production of green hydrogen in these countries could abate around 6.5 G of cumulative carbon emissions, roughly equivalent to combined emissions in United States and Europe. In February 2022, South Africa announced projects worth USD17.8 billion for multiple green hydrogen projects over the span of next decade.

By 2030, European Union plans to install 300 GW renewable hydrogen electrolysers in the region and produce 20 million tons of renewable hydrogen annually. Expanding investments into amplifying green hydrogen production can help EU to reduce reliance on Russia for natural gas imports.

Countries with large swaths of undeveloped land and abundant renewable energy are developing strategies to produce green hydrogen where countries with dense populations and limited renewable resources are likely to import green hydrogen. EU has promised a

Currently, China leads the race to manufacture technology required for the green hydrogen production. The country can produce electrolysers at a fraction of the cost of the US and European competitors. Cheap labour and easy availability of raw materials to build the alkaline electrolysis systems are helping manufacturers build up economies of scale and reduce costs. The country currently produces 33 million tonnes of hydrogen annually, 80% of which is generated using coal and natural gas and the rest comes as by product from industrial sectors. By 2025, China plans to produce up to 200,000 tonnes of clean hydrogen every year. Around 120 projects for green hydrogen production are under process in China in almost all provinces and regions.

Digital Technologies to Expedite Transition to Green Hydrogen Energy

Digital technology is one of the critical levers for accelerating transition to green hydrogen. Integration of artificial intelligence and internet of things can enable optimization and automation of systems, which could facilitate expediting the green hydrogen transition. For instance, digital twin technology provides a virtual model of the assets of a production facility, which help companies make smart choices. Since digital twins can verify tens of thousands of scenarios that can occur in a short term, the technology allows them to automate and improve process efficiency. From conception to designing, leveraging data from every stage through the hydrogen production lifecycles can empower the industry to directly observe interrelated information, which can lower costs and accelerate scale within the green hydrogen ecosystem. Leveraging digital twin technology, investors in the hydrogen production facility can optimize capital expenditure by 10-15% whilst reducing risk by 30-50%.

Real-time monitoring of plants through AIoT leveraging alarms, sensors on assets to monitor KPIs, asset health and cloud-based monitoring beyond control rooms can reduce energy costs by 10-20%. With advanced analytics, energy losses can be prevented by forecasting failures and optimizing electrolyser uptime.

Electrolysers: Key for Green Hydrogen Production

Electrolyzers are devices that split water into hydrogen and oxygen in the presence of electricity, obtained from renewable sources like wind and solar. The electrolyzers consumer around 50-55 kilowatt-hours or units of electricity to produce 1 kg hydrogen. Different kinds of electrolyzers technologies available are Alkaline Electrolysers, Proton Exchange Membrane (PEM) electrolysers, and Solid Oxide. While alkaline electrolyzers utilize alkaline electrolyte solution of sodium/potassium hydroxide, polymer electrolyte membrane uses solid specialty plastic material and solid oxide electrolyzers use a solid ceramic material. Out of three, the proton exchange membrane electrolyzers are the most popular as they produce high-purity hydrogen and are easy to cool. Besides, these are best suited to match the variability of renewable energies. In 2022, Australian company Hysata has created new capillary-fed electrolyzer that are more efficient and cheaper to install and run. Generally, generating a kilogram of hydrogen requires 52.5kWh of energy and it produces only 39.4 kWh of energy. The new electrolyzer can slash the energy cost to 41.5 kWh, which can bring down the cost of green hydrogen at around USD1.50 per kg within just few years of commercializing the technology. More such innovation in the electrolysis technology can help to amplify the green hydrogen production across the globe.

According to TechSci Research report “Green Hydrogen Market – Global Industry Size, Share, Trends, Opportunity, and Forecast, 2017-2027, Segmented By Technology (Alkaline Electrolyzer, Proton Exchange Membrane Electrolyzer, Solid Oxide Electrolyzer), By Renewable Source (Wind, Solar PV, Others), By End Use Industry (Power Generation, Automotive, Chemicals & Petrochemicals, Others), By Region”, the global green hydrogen market is projected to grow at a significant rate during the forecast period. The market growth can be attributed to the rising demand for renewable energy and rising demand for fuel cell electric vehicles.