Dolo 650’s Rise to Fame in India

Amidst the macroeconomic, structural, and microeconomic shifts caused by the COVID-19 pandemic, the Indian pharmaceutical industry responded with agility, exceeding the expectations of governments and markets across geographies. The overall growth of the Indian pharmaceutical industry can be largely attributed to the industry’s leadership in supplying generic formulations to the market, supplying over 40% of generics in the USA, 25% of prescription drugs in the UK, and catering to 60% of the global demand for vaccines. Despite supplying drugs to over 150 countries, India successfully manages to meet domestic needs. Pharma companies have been immensely profiting from the pandemic, making huge profits on the sales of vaccines and complementary drugs. Although the demand for all kinds of medicine is growing rapidly in India with the rising prevalence of chronic and infectious diseases, the antipyretic (for fever) and analgesic (for cold) drugs are particularly in high demand since March 2020 since fever is one of the most common symptoms of Covid. Dolo 650 emerged as one of the most popular brands in the country amidst the pandemic as the drug has become a one-stop solution for every problem—be it body ache, toothache, fever, headache, or COVID-19.

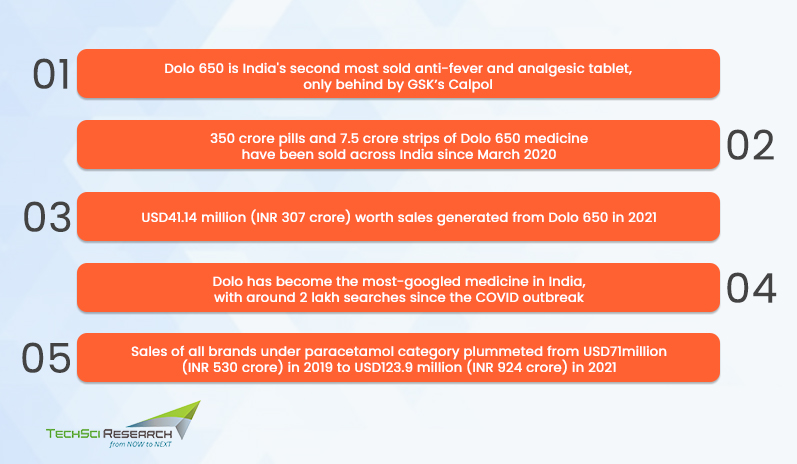

India has sold more than 350 crore Dolo tablets, becoming the second most consumed anti-fever and analgesic tablet in the country, only behind GSK’s Calpol. The annual sales of Dolo medicine have plummeted from 9.4 crore strips or 141 crore tablets in 2019 to 14.5 crore strips or 217 crore tablets by November 2021. The rising popularity of Dolo even made the brand fodder for memes on the internet, wherein the medicine was called “India’s national tablet or favorite snack.”

As the Omicron wave continues to gain a stronghold, the market share of the pill in the 650mg category is skyrocketing, shooting up from 52% in Jan 2021 to 57% in December 2021. Despite being a 30-year-old brand, Dolo has become a household name of great utility and ubiquity. The oval-shaped pill is designed to ensure easy swallowability with the right excipients, substances formulated alongside the active ingredients. Manufactured by Micro Labs Ltd., Dolo 650 tablet sales have garnered INR 567 crore (USD76 million) since March 2020.

Mechanism of Dolo 650

Dolo 650 contains acetaminophen that belongs to aniline analgesics. The antipyretic action of the drug is achieved by inhibiting the production of certain chemicals (prostaglandins) in the body and increasing heat loss from the body. The tablet also stops the transmission of pain signals to the brain, which reduces the pain experienced by the person.

Dolo 650 does not belong to non-steroidal anti-inflammatory drugs, and hence it is not effective against inflammation. Since the side effects of Dolo 650 are rare, it is considered safe as the first-line treatment for fever. Dolo starts action within an hour of administration, and its effect lasts around 4 to 6 hours.

Other paracetamol drugs with acetaminophen that have similar effects, such as Dolo 650, are Calpol, Crocin, Paracetamol, Amidol, Tempros Ultramol, Ifimol, Utragin, and others.

What made Dolo 650 Popular Among Masses?

Unique Brand Positioning

While the market was flooded with paracetamol 500, there was no player in the paracetamol 650 segment until Micro Labs made its entry with Dolo 650 in 1973. The company identified the space between normal fever and high fever and started encashing on the clinical evidence that 650 mg provides superior relief.

Dolo consists of the same kind of generic salt as found in other anti-fever drugs like Crocin or Calpol, but the manufacturer’s strategy to render the drug effective for ‘Fever of Unknown Origin (FUO)’ as a part of their brand promotion increased the trustworthiness of the drug for Covid among Indians. Some may attribute the success of Dolo to its relatively simple name, compared to other drugs in the market for cold, flu, and fever.

Indirect Promotion

The indirect promotion of Dolo through memes and posts on social media platforms turned out to be quite significant for the drug sales. However, the promotion and advertising of any prescription drug is in violation of the Drugs and Magic Remedies Act. Being a favorite among healthcare professionals, Dolo-650 has always remained the number one paracetamol 650 mg brand prescribed in India for decades. However, since doctors were not seeing patients personally during the lockdown period, the prescriptions of Dolo-650 started floating on WhatsApp, SMS, and voice messages, and word-of-mouth led to its immense popularity among families across the country.

Vaccination Drive

After introducing COVID-19 vaccines such as Covaxin and Covishield, the government inoculated the biggest vaccination drive to immune the population. However, people started experiencing symptoms like fever and body ache after taking the vaccine, which further accelerated the intake of Dolo-650. The brand helped in enhancing awareness for vaccines by addressing doubts through posters that answered the Frequently Asked Questions about vaccines. These posters, available in English and local languages, helped popularize the brand at the grassroots level. Additionally, the brand reached out to healthcare professionals and provided a sample of Dolo-650, masks, and sanitizers for recommending the drug to people if they got fever and pain post vaccination.

Safer Alternative

One of the key reasons behind the widespread adoption of Dolo 650 is that the drug is time-tested and suitable for people of all ages. The medication has minimal side effects and is even safe for those suffering from cardiovascular disorders, renal diseases, or diabetes.

The Growing Trend of OTC Medications

If doctors prescribe the same drug for an illness, consumers become confident of its usage. They are likely to buy medicine over the counter rather than visiting doctors for common illnesses to save money or time in visiting doctors personally. Besides, the expansion of drug sales to online platforms that gives the flexibility of consumer convenience, multiple product options, price comparison, etc., has further led to the growth of OTC medications in recent years.

However, consuming the OTC medication without a prescription can prove dangerous. Hence, the indirect marketing of Dolo-650 along with its wide accessibility contributed to tremendous sales of medicines. For example, some common side effects of Dolo-650 include liver damage, skin rashes, increased heartbeat, low platelets, etc.

COVID-19 Drugs Amongst Top-Selling

Indian pharma companies sold more than INR26,000 crore (USD347.9 million) worth COVID-19 drugs from 2020-2021. Favipiravir cornered 50% of the total sales worth nearly INR1300 crore (USD174 million). COVID-19 drugs remained among top selling brands for pharma players in India within the past two years. Anti-viral drug Favipiravir emerged in the top club, leaving behind long-selling cardiac, respiratory, and other key brands that used to dominate the market.

From April 2020 to 2021, Favipiravir mopped INR762 crore (USD111 million) sales, higher than the anti-diabetic drug, Glycomet-GP. Favipiravir is an early-use antiviral drug, which is being prescribed and used widely in COVID-19 therapy across the country. The drug sales plummeted after receiving emergency use authorization in June 2020. Currently, over 30 companies produce Favipiravir in 400 mg and 800 mg options.

As India grapples with the third wave of coronavirus dominated by the Omicron variant, the demand for antiviral drug Molnupiravir is growing. Millions of doses had already been distributed within the first week of January 2022, and doctors in the working community settings have begun pre-ordering the drug.

Currently, Molnupiravir is manufactured by 13 pharmaceutical companies in India despite Indian Council of Medical Research criticism regarding the efficacy of the medicine for the treatment of COVID-19. However, the drug has been approved for emergency use by the Drugs Controller General of India (DGCI).

Way Ahead

Dolo-650 has been developed by Bengaluru-based Micro Labs and the medicine is successfully competing against the global pharma giants in the same segment. Consumers are reducing their reliance on foreign-manufactured medicines as Indian pharma companies are introducing locally manufactured, safer, and affordable alternatives for treating various diseases. Indian pharma sector contributed approx.

1.7% to the country’s GDP in 2021 as compared to its contribution at 1% a decade ago. India is on the way to becoming the ‘world’s pharmacy’ as the country is repositioning itself as a global leader in drug development. New policies like PLI Scheme for encouraging the manufacturing of APIs, stable policies, and regulatory transformations, and strong collaborations in the industry are positioning India as an innovation hub for the pharma sector.

According to TechSci Research report on “India Paracetamol Market By Source (In-house v/s Contract Manufacturing Organizations), By Product (Powder v/s Granules), By Form (Tablet, Capsules, Oral Solution), By Route of Administration (Oral v/s Intravenous), By Distribution Channel (Online v/s Offline), By Application (Pain & Fever Reliver, Muscle Cramps, Cold & Cough, Others), By End User (Adult v/s Pediatric), By Company, By Region, Forecast & Opportunities, FY2026”, India paracetamol market is anticipated to grow at a significant rate during the forecast period. Widespread use of drug as a first line of treatment as pain and fever reliever as well as supportive government policies for pharma sector are the primary driving factors for the growth of India Paracetamol market.

According to another TechSci Research report on “India Over the Counter (OTC) Drugs Market By Product (Cough, Cold and Flu, Analgesics, Dermatology Products, Vitamins, Mineral and Supplements (VMS), Other), By Dosage Form (Tablets, Capsules, Powders, Ointments, Liquids), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacy, Other), By Company, By Region, Forecast & Opportunities, FY2026”, India over the counter drugs market is anticipated to grow at a formidable rate owing to factors such as rising awareness among population pertaining to application of these medicines and growing number of online platforms providing OTC medications.