Challenges for Online Express Grocery Delivery Market in India

On May 10th, 2022, the food delivery major, Swiggy, announced to suspend its grocery and daily essentials delivery service operations, Supr Daily, in five cities, Delhi-NCR, Pune, Hyderabad, Mumbai, and Chennai. The subscription-based grocery delivery service acquired by Swiggy in 2018 enabled customers to place their orders for milk, daily essentials, and groceries by 11 PM and get them delivered at their doorsteps by 7 AM the following day. Supr Daily delivered 2 lakh orders daily across six cities to over 5 lakh customers. Supr Daily would be continuing its operations in Bengaluru and double up significant efforts towards growing its customer base in the city. However, Supr Daily gave Swiggy a head-start to grow its journey beyond food delivery and venture into convenience and grocery. As consumers’ buying habits are evolving, gradually shifting from larger monthly purchases to smaller weekly ones, the trend of quick commerce is catching up. Besides, the COVID-induced behavior has led to more households opting for time-bound deliveries, owing to busy consumer lifestyles and growing demand for convenience and immediate services.

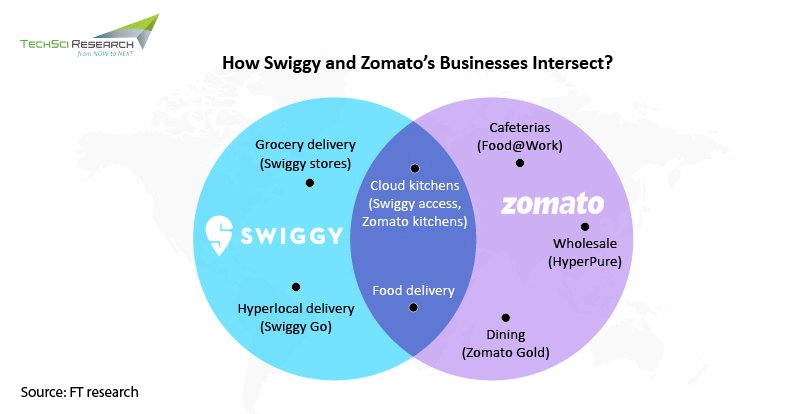

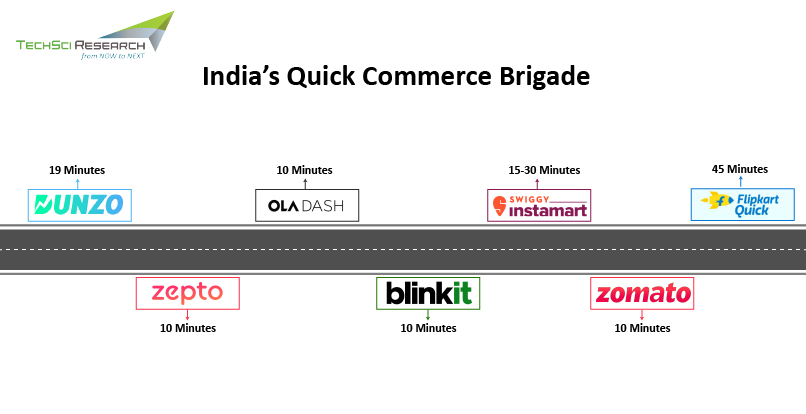

Over the last four years, Supr Daily successfully managed to create a niche in solving essential consumer needs, but unfortunately, the company failed to chart a clear path to profitability. Swiggy had been incurring major losses from Supr Daily, and the move to disband services is a part of an effort to pull the plug on its multiple businesses and focus on its profitable business areas- food delivery and Swiggy Instamart. Swiggy entered the decacorn club after raising USD700 million at over USD10 billion valuations. The company has invested around USD700 million to expand its quick commerce business further. Instamart is a competitor to hyperlocal delivery platforms Dunzo and Blinkit.

Why are Online Grocery Delivery Startups Failing?

Over the last decade, many online grocery delivery startups have emerged in several cities of India on account of the internet explosion and the surge of digitalization across the country. Besides, the changing lifestyle of consumers, rising internet penetration and changing behavior towards online shopping contribute to the steady growth of online grocery delivery startups. But many of these startups have failed despite the booming market due to certain factors.

· High Customer Acquisition Cost

High customer acquisition costs or money spent to lure people into buying groceries has become a bane for India’s grocery retailing sector. The cost of delivering orders is almost three times compared to the revenue earned. Besides, higher discounts offered to the customers for creating a customer base as part of the expansion plan and succeeding over existing platforms result in lesser revenue than incurred costs. The primary target audiences of the food delivery service providers are young consumers and the working population. Hence, these startups spend hefty sums on marketing efforts and engage audiences on social media to tap the potential customers. While aggressive marketing campaigns make the new ventures popular, they do not yield the desired results or bring expected client volumes. Negative margins, huge marketing costs, and splashed discounts are some of the financial ordeals leading to a slow withdrawal of startups or failure altogether.

· Grow Big Fast (GBF) Strategy

Many grocery delivery startups are focusing on the rapid expansion of their operations to cater to several cities’ demands rather than focusing on one city at a time. They are racing to meet demands on all fronts with an increasing number and types of items to be delivered and promising quick fulfillment. Every city has a different consumption pattern depending on the demographics. A strategy that might work wonders to establish and grow a loyal customer base might not work in others, which later costs businesses a hefty price. Opting Grow Big Fast (GBF) theory rather than cracking up business in one city led to lower order volumes and high operational inefficiencies. The quick delivery approach does not comply in third-tier cities of India since, unlike Mumbai or Gurgaon, customers are scattered all over the city, which implies a higher cost and more time per delivery. In small cities, customers prefer asking the neighborhood stores to deliver items at home rather than relying on the app.

· Shortage of Delivery Personnel

From major food delivery brands to startups, everyone is facing a severe shortage of delivery personnel, making them unable to meet the rising demands of consumers. Workers are battling rising fuel prices and inflation amidst the surge in demand for services. The effects of fuel prices severely affect riders’ compensation structure, leading to a greater rider churn rate. More than 40% of Swiggy and Zomato riders leave within a month. Many gig workers are choosing to return to their pre-pandemic jobs as companies are not increasing payouts to riders despite skyrocketing fuel prices. Between March and April 2022, the rider assignment time went up by 10%, but delivery time increased by 2.5 times. While the demand has substantially increased, companies have not been able to keep up with the supply. Besides, minuscule delivery windows in cities known for heavy traffic, such as Delhi, Mumbai, or Bengaluru, are exacerbating pressure on delivery workers who are already contending with long hours and paltry pay.

How could Online Grocery Businesses Succeed?

The online grocery market is projected to register growth at a formidable rate in the next decade as more and more consumers are likely to turn to online mediums to fulfill their daily needs. Thus, market players involved in the segment should address the challenges and improve their long-term prospects to register steady growth. Here are some of the ways through which grocers can do a profitable business.

· Personalization is the Key

A personalized grocery shopping experience with effective marketing strategies can help grocers create digital alternatives to offline opportunities, leading to more effective results. Identifying patterns to develop customer-specific offers based on their shopping preferences, frequently purchased items, average basket size, etc., rather than following a generalized marketing approach can help entice customers better. Also, customization will help build a sense of trust among customers, and relevant deals and offers would save valuable time for customers while providing them a unique shopping experience. However, retailers must ensure not to overdo personalization as it could overwhelm consumers.

· Improving Customer Experience

Customers turn to online mediums to fulfill their grocery requirements for convenience and quick delivery. A bitter customer experience can make grocery eCommerce extra challenging for merchants to form a loyal customer base. Providing consumers with intuitive navigation and features such as favorite products, suggested products, saved shopping lists, etc., can help meet and satisfy customer expectations. Owing to growing consciousness towards health and well-being, shoppers are looking for products that do not have allergens, carbohydrates, fats, sugar or are meant for vegan populations. Thus, retailers need to provide extensive product filtering and diverse shopping preferences that simplify the process of finding products.

· Expanding Omnichannel Capabilities

Many grocery retailers are now expanding their omnichannel capabilities for online ordering and refining their storage and distribution process to meet the requirements of consumers at the booked slot. Online grocers are focusing on the development of dark stores (also known as micro-fulfillment centers), which store products to make rapid online order fulfillment. Like any other grocery store, a dark store has shelves and racks to keep groceries and other essential items. Dark stores can help grocers deliver perishable items such as meat, fruits, and vegetables while remaining fresh for a pleasant customer experience and eliminating wastage. As consumers would continue to demand convenience, dark stores will help online grocery retailers optimize their supply chain.

· Zepto’s 10 Minute Grocery-Delivery Success

Instant grocery delivery startup, Zepto has become India’s rapidly growing segment. Launched by two teenagers, Zepto has managed to increase its revenue by 800% quarter-on-quarter within just nine months. Zepto works with 86 dark stores and has a network of ‘cloud shops,’ or micro-warehouses, to fulfill orders promptly. The company’s secret to success is routinely producing 2500+ goods for delivery in under ten minutes, which helped them develop and maintain incredible client loyalty. Zepto has become a rival with already established players like Amazon, Flipkart, Dunzo, Swiggy, and Blinkit. The company has become profitable in dense city neighborhoods and small micro-markets. Zepto plans to start a service to deliver coffee, chai, and other café items in under 10 minutes besides groceries in some selected areas of Mumbai.

As companies from Reliance to Bigbasket and Swiggy to Ola are putting their top dollars into serving daily groceries at the doorstep of consumers, express online grocery delivery is going to become the next battleground for growth.

According to TechSci Research report on “India Online Grocery Market By Product Category (Packaged Food & Beverages, Personal Care, Household Products, Fruits & Vegetables, & Others {Pet Care, Baby Care, etc.}), By Platform (Mobile Application & Desktop Website), By Region, Competition, Forecast & Opportunities, FY2017-FY2027”, India online grocery market is projected to grow at a formidable rate during the forecast period. The market growth can be attributed to the changing lifestyles and rising health consciousness among population.

News Source:

https://www.techsciresearch.com/blog/challenges-for-online-express-grocery-delivery-market-in-india/1305.html