Can India Become the Pharmacy of the World?

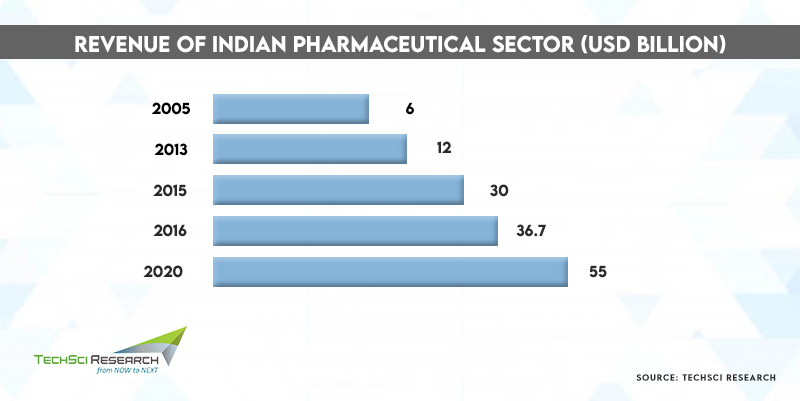

The Indian Pharmaceutical industry has evolved incredibly in the past five decades, becoming the sunrise sector of the country. According to India’s Ministry of External Affairs, the Indian Pharmaceutical sector is poised to grow to USD100 billion by 2025 with its radical innovation and ability to provide medicines and medical support to various nations across the globe. Even during the pandemic, the Indian pharmaceutical industry continued to produce and distribute life-saving medicines and vaccines at affordable costs across the world, which contributed to the pharmacy industry’s steep growth.

At present, India comprises over 3000 pharma companies and 10,500 drug manufacturing facilities, which makes the Indian pharmaceutical industry the 3rd largest in the world in terms of volume and 11th by value. India is the only country to have the largest number of US-FDA compliant pharma plants outside of the US. India is the second-largest supplier of pharma and biotech professionals after China, comprising nearly 20%-22% of the global export volume. The net drugs & pharmaceuticals export volume stood at USD24.44 billion in FY2021.

Role of Indian Pharma Industry in Response to COVID-19

Amidst the global crisis led by COVID-19, Indian pharmacy companies fulfilled the global demand for generic drugs as well as vaccines. India supplied around 20% of the world’s generics and 62% of its vaccines, maintaining the supply of existing drugs and manufacturing others. The pharma industry’s ability to accelerate the production of drugs and medicines and deliver them at cost-effective prices to around 133 countries has helped the country to maintain its reputation as the “pharmacy of the world”.

Key Factors Leading to the Growth of Pharmacy Industry

Government Support for Production Boost

Leading pharmaceutical firms have an adequate capacity to not only serve the Indian market, but also supply the world. Although India sells pharmaceuticals to over 200 countries around the world, it imports high-value patented medicines for domestic use. The pharmaceutical manufacturing supply chain involves mainly two stages, production of APIs and production of formulations. For more than a decade, China has remained the largest producer of active pharmaceutical ingredients (APIs) in the world. To reduce reliance on China for APIs, the Indian government has introduced the Production Linked Incentive Scheme, making an investment worth USD2.04 billion.

The PLI scheme intends to promote the domestic manufacturing of critical drug intermediates and APIs in the country as well as boost their pharmacy exports, incentivizing eligible manufacturers of identified 53 critical bulk drugs on their incremental sales for a period of six years. Additionally, the government has planned to finance the construction of three bulk drug parks, making an investment of around USD394 million over the period of next five years.

India’s Foreign Direct Investment policy allows 100% FDIs in greenfield pharmaceutical projects and 74% FDIs in brownfield projects. From FY01-FY21, the India drugs and pharmaceutical industry has managed to attract approximately USD18 billion in foreign direct investments.

India’s first post-pandemic budget provides a boost of nearly 200% for developing the pharmacy sector, earmarking INR124.42 crore for initiatives aimed at “Development of Pharmaceutical Industry”.

Increasing Research & Development Activities

Over the years, India has emerged as a global ‘medical superpower’ with its R&D efforts. The average R&D expenditure of the Indian pharmaceutical companies used to be less than 13% of their annual turnover, but now the scenario is gradually changing. In FY2020, Indian Pharmaceutical company, Lupin invested a sum of USD225 million (14.3% of annual turnover) on R&D efforts, while the lowest investment was made by Torrent with USD57 million. Some of the new R&D units are now equipped with sophisticated laboratory equipment, instruments, and pilot plant facilities, as well as high-skilled R&D manpower proficient in conventional techniques. Earlier, R&D was limited on the standardization of raw materials and final products using conventional screening techniques, but now many companies are leveraging modern scientific methods and toxicity studies for validation of chemical formulations.

The amount of money devoted by the drug companies depends on the amount of revenue they expect from the sale of a new drug, the expected cost of developing a drug, and policies influencing the supply and demand of the drug. With new government policies favoring the domestic production of generic drugs and other medicines as well a boost in demand for drugs globally owing to the rising incidences of chronic diseases, more R&D efforts are being initiated by Indian Pharmaceutical companies.

After introducing the PLI scheme to boost domestic production of APIs, the government is planning to revamp Research and Development policy. The new policies will intend to commercialize scientists for their innovations and encourage research towards new drug and molecule discoveries as well as high-end medical devices.

Rising Inter-Organizational Collaborations

The alliances and partnerships formed between pharmaceutical companies are highly beneficial to domestic economic development in India as well as enhanced patient access to affordable medicines. The collaboration provides immense opportunities for the discovery, development, and manufacturing of innovative therapeutics and novel treatments as well as strengthen manufacturing and supply base in domestic and global markets. Recently, pharmaceutical companies, Cipla and Kemwell have formed a partnership to develop biosimilars for pulmonary disorders. Aurobindo Pharma has collaborated with a US-based biotechnology company, COVAXX, to developa UB-612 peptide-based vaccine to fight the coronavirus. The partnership is expected to support up to 480 million doses of UB-612 vaccines for India as well as other countries. Dr. Reddy Institute of Life Sciences and the Department of Science and Technology are partnering to discover and develop drugs against psoriasis.

Technological Advancements

Increasing adoption of prominent technologies such as artificial intelligence, additive manufacturing, blockchain, and other Industry 4.0 technology are significantly impacting the discovery and development of drugs. More than a third of pharma start-ups are working on the key software solutions for the industry to address the various challenges in the pharma industry. Artificial intelligence and machine learning are revolutionizing the pharma industry, improving the success rate of medication development, disease identification and diagnosis, and streamlining R&D activities. Initial screening of drug compounds and next-generation sequencing helps in the faster discovery of drugs and personalized medication for individual patients.

Predictive forecasting leveraging machine learning and artificial intelligence technologies help to plan supply chain to get the inventory at the right time and in right quantities. Blockchain technology is also providing pharmaceutical executives the opportunities to tap into new business potential and build better relationships. The increased adoption of telemedicine and smart medical devices and wearables are generating biggest revenues for pharma companies. Pharmaceutical companies are actively launching devices intended for specific medical issues or demographics.

Challenges Ahead

Although the pharma industry is witnessing steep growth, some key challenges may create a challenge for the Indian industry players to reach their full potential and compete well in the global market scenario. A lack of stable pricing and policy environment in India creates uncertainty for investments and innovations. While the Indian government wants to reduce the prices of generic medicine to meet its national healthcare mandates, the industry strongly pushes back on the demand as the prices of generics are already cheap, compared to global markets. Nearly 18% of the Indian pharma market is already under price control, which is beneficial for the consumers, but not for the industry stakeholders.

Setting up bulk drug parks does not address many systematic issues, which puts India at a disadvantage vis-à-vis China. High labor costs, unstable power supply, higher tax and lending rates are some of the factors responsible for the high cost of manufacturing APIs. If the cost of API is higher, then keeping the prices of Indian drugs at a low cost in the globally competitive market would be difficult. Also, increasing the scale of production of APIs to China could hamper the export competitiveness of products.

Conclusion

India has developed a significant position in the global generics market, building a reputation of being a dependable, high-quality, and cost-effective drug supplier. Investing in emerging product categories such as biosimilars, gene therapy, and speciality medicines as well as exploring underpenetrated international markets, can help increase exports can further help to boost the Indian pharmaceutical sector. The growth of the domestic pharmaceutical industry will significantly contribute towards the country’s economic prosperity and increase net foreign exchange revenues to USD30-40 billion annually by 2030.However, challenges such as domestic price control, reliance on imports for raw materials, generic price erosion, rising market rivalry, greater regulatory control, and new tax systems may undermine the growth of the pharmaceutical sector in the country. With low-cost skilled manpower and a well-established manufacturing base, India will continue to lead the source of path-breaking innovation in the medicine domain and become a “pharmacy of the world”.