A Look at Saudi Arabian Consumer Finance Market

It is no secret that Saudi Arabia is trying its hardest to diversify its economy. Countless litres of ink has been wasted on the need for diversification, the nature of the oil market and oil prices etc. Wiser heads have been discussing these issues at length and have offered a diverse set of opinions on the issue; however, they all agree that economic diversification is not debatable at this point.

It is better for the strength of the economy and will break the Saudi addiction to a good whose value is entirely up to the goods of supply and demand.

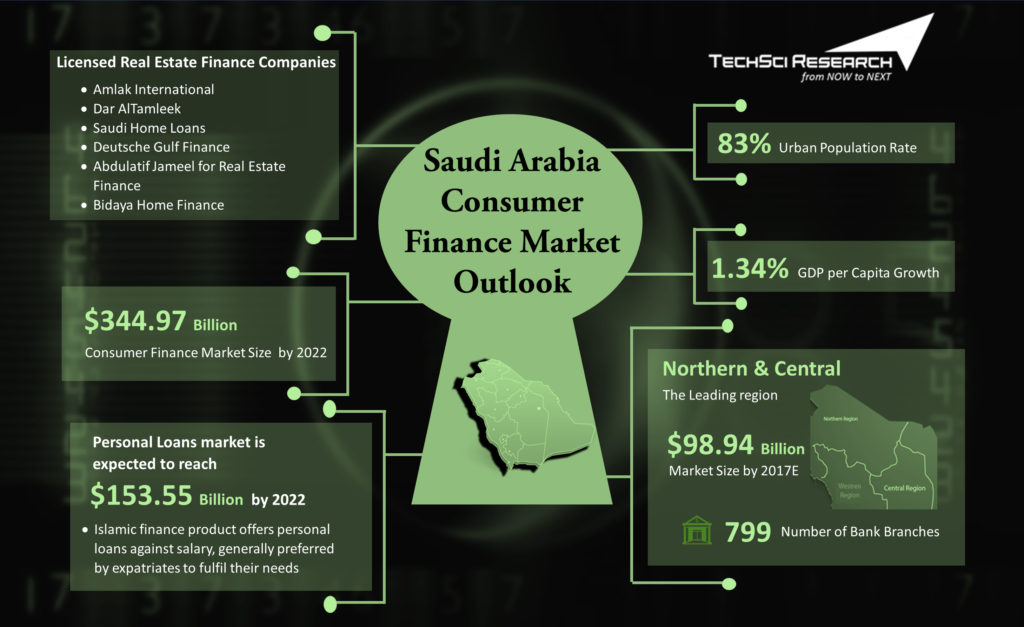

So how does one go about reforming the economy? Well the first step to the process is to set up infrastructure, both social and physical. While Saudi Arabia boasts of immaculate physical infrastructure, any budding enterprise also needs adequate financing, for creating a business, reinvesting in the business and for consumers to avail in case the business is creating tangible products for consumption. This is a somewhat tricky proposition, as per TechSci Research report “Saudi Arabia Consumer Finance Market By Type, Competition Forecast & Opportunities, 2012-2022”, due to the nature of banking system in Saudi Arabia.

Most banks work on a simple enterprise. A consumer puts a certain amount of money in his or her bank account. The bank then takes this money and gives it to industrialists, the government etc. at a higher rate of interest to be paid back with the principal after a certain amount of time.

The money is then returned to the consumer’s account along with the amount of interest accrued by the consumer. The difference between the interest rate charged by the bank on the industrialist and the interest to be paid to the consumer, is kept by the banks.

Saudi Arabia, however strictly follows the Sharia, which prohibits usury, which is problematic for most banks. However, Saudi Arabian banks have devised clever workarounds which ensure value addition for the consumer of bank products and for the banks themselves without having to rely on charging steep interest rates on borrowers.

To give a simple example: supposing a business needs to buy a light commercial vehicle (LCV) to propogate its business but it doesn’t have the funds to purchase it ourtright; the business goes to an Islamic bank, which, after due diligence, purchases the vehicle for the business and rents it out to them.

The business is expected to pay back the loan amount over the agreed upon time period, and the bank makes a certain amount of money based on the rent paid by the business for the use of the LCV, thus circumventing the idea of usury. This is only one of the various ways in which Islamic banks manage to stay afloat and prosper without charging interest payments.

With Saudi Arabians leveraging their current economy to move to a non-oil based one, the role of Islamic banks will become extremely important, given the rising need for microfinance in the coming few years. “Saudi Arabia Consumer Finance Market Competition Forecast & Opportunities, 2012-2022” is a report that manages to provide a birds eye view of the banking situation in the country and shed light on its multifarious facets.